It seems like everyone is chomping at the bit to get a piece of NFT action. Investors, collectors, and people with too much money are spending millions of dollars on these digital assets. So why shouldn’t you buy NFTs?

Ten reasons why you shouldn’t buy NFTs include a volatile market, scams are abundant, you’re subject to capital gains tax, most NFTs provide no value, NFTs can be stolen, the tech is new, the barrier to entry is high, you can lose money, the bad environmental impact, and it requires research.

To be honest, this article isn’t necessarily a list of why you shouldn’t buy an NFT as much as it is a list of things to be aware of before buying an NFT.

1. Volatile market

First and foremost, the entire NFT market is extremely volatile. Especially at this point when brands and businesses are just beginning to incorporate NFTs into their companies. Many of the NFT brands that exist today will be negatively affected as soon as people can ween out the bad from the good.

Moreover, the blockchains that NFTs are built on are volatile all on their own. The price of cryptocurrencies are fluctuating by the second, and as a result, so do the prices of NFTs. Even the most popular NFT blockchain, Ethereum, experiences drastic price changes. Who’s to say that any of these blockchains will even last?

My main concern is the fact that 98% of NFTs currently on the market are bad investments, simply because they were created as cash-grabs, and not as brands that are here to stay for the long run. Although many of these cash-grab projects might be holding value now, as the market continues to adjust, these short-term projects will eventually decline in value.

2. Scams are abundant

Just as with any industry that involves large amounts of money and tricky technology, the NFT space is full of scammers. Considering how foreign NFTs are too many people and how easy it is to transfer money and digital assets, the space is a gold mine for scammers.

Scammers often take advantage of the lack of knowledge in the space; creating fake websites, DM’ing phishing links, and even acting as the help desk for major companies in the NFT space. Unless you are well aware of all the scams in the NFT space, you should not buy an NFT. More than likely, you will just get scammed anyways.

3. Subject to capital gains tax

Many people have indeed made hundreds, thousands, and even millions of dollars buying and selling NFTs. However, that doesn’t mean that you don’t have to give a large chunk of your earnings to the government. All profits made in the NFT space are subject to capital gains tax.

If you sell an NFT for a profit within a year after buying it, you have to pay short-term capital gains tax(meaning you’re taxed up to 37%). Likewise, if you hold your NFT for over a year, you are still subject to paying long-term capital gains tax (0 – 20%).

But, aren’t NFTs decentralized? They are, but the government doesn’t care. Since the blockchain is a digital public ledger, the IRS can view all of your NFT transactions. That means if you don’t pay taxes on your NFTs, the IRS will likely audit you, which can result in hefty fines and legal ramifications.

4. Most NFTs provide no real value

In today’s world of NFTs, the majority of NFTs provide zero actual value. No physical product or services, no contracts or terms of agreement, literally nothing. You are paying for an image on a screen. Sure, that image could have value if a reputable person or brand is the creator, but that is hardly the case for most NFTs.

That’s not to say that all NFTs are worthless, just a majority of them. I believe this is only temporary and NFTs will soon be thought of much differently than they are today. Many of us see NFTs as cash grabs, and most of them are. In the future, however, NFTs will be heavily utilized in all industries and will play a much more important role and provide more value to holders.

NFTs can be used as contracts for loans, to provide real-world access to events, prove ownership of digital and physical goods, plus a plethora of other things.

5. NFTs can be stolen

If the thought of getting scammed in the NFT space isn’t scary enough, your NFTs can also be stolen. Millions of dollars worth of NFTs have been stolen. To be fair, an NFT can’t simply be stolen from your Web3 wallet, rather, you have to allow a hacker access to your wallet. As silly as this may seem, it happens often.

A stolen NFT is generally the result of clicking on a bad link or exposing your secret phrase, all of which is the result of user error. It’s important to understand all the ways your NFT can be compromised and even more important to know how to keep your NFTs safe. After all, the best defense is a good offense.

6. Technology is still new

Although the first NFT was technically minted in May 2014, the technology didn’t gain mass attention until 2021 when artists like Beeple and FEWOCiOUS began selling their art as NFTs for large sums of money. It didn’t take long for news to hit the headlines of numerous big-name media outlets, resulting in a curiosity spike and the formation of a small niche NFT community on Twitter and Discord.

This sudden boom of NFTs opened up the door to many artists and creators as a way to sell their products and build their brands. It didn’t take long for the technology to become the modern-day digital gold rush, with a majority of the community pumping out digital art in an attempt to cash in on the insanely bullish market.

Ultimately, this market behavior has developed a negative perception from those outside looking in. The point is that it’s difficult to separate the bad from the good, and pinpoint what will last and what won’t.

I believe that NFT technology in the macro will be a huge part of our economy’s future, but certain aspects and platforms might not make it past next year. Meaning that buying an NFT or investing in related technology is very risky.

7. The barrier to entry is high

NFT technology can be extremely complicated, especially if you are new to the space. The high barrier to entry is offputting to most, and many people aren’t willing to risk their time or money on something that doesn’t make sense.

The barrier to entry is that you have to set up a digital wallet to buy cryptocurrency before you can buy an NFT. But before you do that, you need to know which blockchain you want to buy an NFT on because that will determine the wallet and cryptocurrency you use.

Are there resources out there to help you such as Cyber Scrilla? Of course. But that requires time and effort that not everyone is willing to put in, and that’s okay. The barrier to entry is an understandable speedbump, so if you aren’t willing to put in the time and effort to learn about the technology, buying an NFT isn’t for you.

8. You can lose money

According to serial entrepreneur Gary Vaynerchuk, the amount of money that will be lost on individual NFT purchases because of the supply and demand issue that will appear over the next few years will be significant.

“Let there be no confusion; every celebrity, every IP, every league, every movie, every intellectual property, and every influencer and human will have an NFT project in the next 24 months which will lead to an extraordinary level of too much supply, and the demand will not be able to keep up with it.

So the early projects right now that are getting disproportionate economics are going to be affected poorly, and we will have this March – April 2000 internet stock moment. On the flip side, when all those things collapse, there will still be Amazon and eBay in there, the way there was in 2000,” said Gary.

His statement is a testament to the fact that there are too many short-term projects providing minimal value to holders that will eventually plummet as soon as the market adjusts, leaving collectors and investors with even less than what they started with.

If you aren’t willing to do your research on how to assess the price of every NFT you buy, then you are at an even greater risk of losing money.

9. Bad environmental impact

Although it is a temporary concern, in my opinion, the negative environmental impact of NFTs is worth noting as a reason why you might not want to buy an NFT. The entire process of creating an NFT to selling it consumes a lot of energy.

From minting to sale, an NFT uses approximately 340-kilowatt hours of energy. This is more than one-third of the energy a typical American home consumes in one month. This figure excludes the energy needed for designing the NFT, as well as other blockchain transactions.

This negative impact is mainly the result of the proof of work standard (PoW) utilized by the Ethereum blockchain, which happens to be the most-used blockchain. The PoW standard requires a large amount of energy to solve complicated algorithmic problems using computers.

The good thing is that most other blockchains use different mechanisms that are much more environmentally friendly, and even use profits to purchase carbon removal credits that help offset the negative environmental effects of some blockchains.

Furthermore, Ethereum won’t be using the PoW standard for much longer as it is in the process of being upgraded to what’s called a proof of stake (PoS) mechanism that is much more environmentally friendly, and consumes less energy.

10. Requires research

As I was writing this, I thought that maybe this was too obvious of a point to make. However, I swiftly reminded myself that not enough people understand that buying an NFT requires a generous amount of research. So, what kind of research am I talking about and how much of it do you need to do?

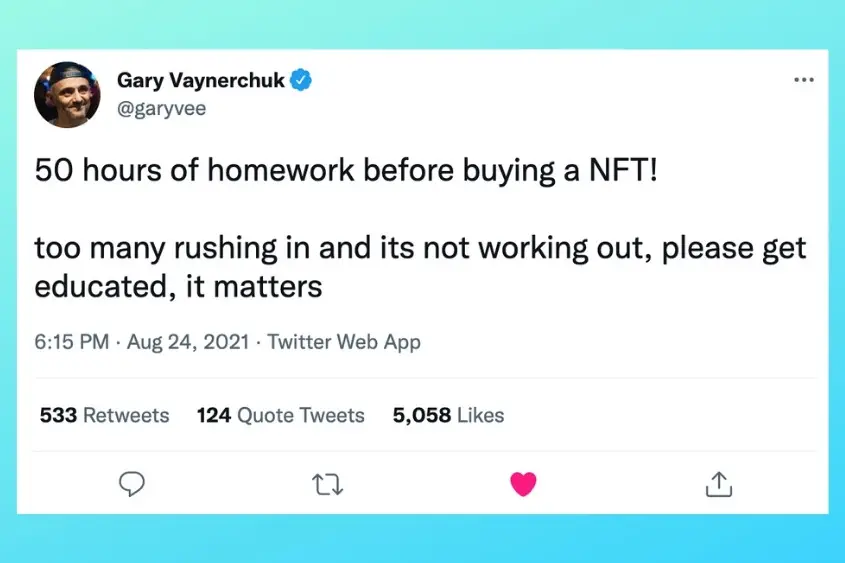

According to this Tweet from Gary Vee, you should do a minimum of 50 hours of homework before buying an NFT.

“50 hours of homework before buying an NFT! Too many rushing in and it’s not working out, please get educated, it matters.”

I know what you’re thinking, 50 hours is a lot of homework. I didn’t even spend that much time doing homework throughout all my years of schooling and believe me, my grades reflected it. That is exactly what you should expect if you aren’t willing to put in the time to do your research when it comes to NFTs — poor results.

There is no way around it. If you want to buy an NFT and do it “the right way”, you have to do your research. That means reading articles, watching videos, asking questions, and getting your hands dirty. Moreover, Gary is talking about 50 hours of research on a single NFT brand, not the entire space in general.

If you are serious about buying an NFT and continuing to buy NFTs, then you need to spend time learning about the space. So if you don’t have the time or you simply aren’t interested in spending your time doing the necessary research, you might want to reconsider buying an NFT for now.

Buying an NFT isn’t for everyone, at least, not yet. The technology is still so new that it makes it difficult to know exactly what you are buying or if it’s a good buy. Eventually, NFTs will be the new norm, but for now, you should be aware of what you’re getting yourself into before taking the plunge.