Trying to decide if you should get a hardware wallet or not can be tough. You’ve likely heard they’re the most secure way to store your digital assets but, you’re also aware of the cost.

Having used a hardware wallet for years, I’m here to help you decide if a hardware wallet is really necessary with a list of pros and cons.

Should You Get A Hardware Wallet?

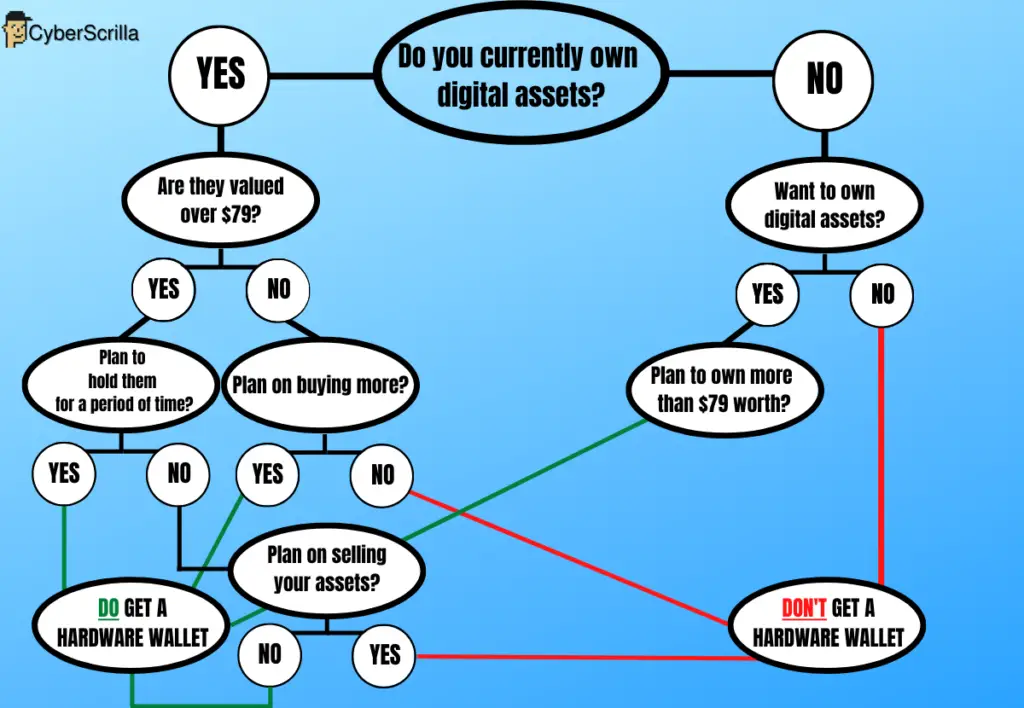

If your currently own more than $79 worth of crypto or NFTs you should consider getting a hardware wallet. By not storing your digital assets in a cold-storage wallet, they’re at an increased risk of being stolen as they’re more susceptible to hacks and scams.

Nonetheless, I realize everyone is at a different point in their blockchain journey. You’re likely either just getting started or you have a basic understanding of Web3 technology and you’re looking to make wiser decisions as you progress.

If this sounds like you, then you’re in the right place.

And if you’re someone who believes you could never be scammed—think again. Even the most proficient crypto investors have been scammed.

Below is an extensive list of reasons why you should get a hardware wallet.

Hardware Wallet Pros

Your wallet’s private info is stored offline

Unlike software wallets which store your recovery phrase in the software online, a hardware wallet keeps your private key, recovery phrase, and PIN code on the device itself.

Assuming you use a hardware wallet properly (solely as a storage solution), you completely eliminate the risk of a scammer or hacker getting ahold of your wallet’s secret phrase.

By keeping it disconnected from the internet, there’s no way someone could ever steal your phrase.

Hardware wallets are less susceptible to hacks

There is a long list of reasons why hardware wallets like Ledger are less susceptible to hacks.

Of course, the main reason is that it’s disconnected from the online world where hackers and scammers lurk in every corner.

Beyond being disconnected from the rest of the world, these wallets utilize advanced security hardware such as secure chips, which are also found in your bank card and passport.

This combined with other security measures ensures your wallet remains secure from both physical and digital attacks.

You remain in complete control of your assets

Although many software wallets like MetaMask enable you to own your keys and your assets (also known as self-custody) they do so with less security.

There are no doubts that owning your wallet’s private key is a huge safety factor when considering which crypto wallet to use, especially after the FTX fiasco.

But, why not take security even further by using a cold-storage wallet?

This way, not only do you own your keys, you literally own the physical device that holds your keys versus a software wallet that could be compromised at any time.

Hardware wallets are compatible with multiple blockchains

Beyond their numerous security features, hardware wallets also have several functionalities that are likely preferred, especially if you’re a serious collector, trader, or investor.

Both Ledger and Trezor—the current leaders in the hardware wallet industry—are compatible with numerous blockchain networks such as Bitcoin, Ethereum, Dogecoin, Chainlink, Litecoin, Cardano, and Solana.

So, not only are these wallets compatible with thousands of coins associated with these networks but they can be used to manage NFTs as well. This saves you the hassle of having to manage multiple wallets.

The cost is negligible compared to the security benefits

Determining whether or not you should get a hardware wallet largely comes down to cost.

After all, these wallets range anywhere from $79 to over $250, which is much more compared to software wallets that are free to download and use.

That said, the price is negligible when you consider the numerous security advantages you gain when you use a hardware wallet.

That’s why I say if you own more than $79 worth of digital assets (the cost of a hardware wallet), you should absolutely get one.

Owning valuable assets and not storing them in a secure wallet is like owning a fancy car and not storing it in your garage because of the electricity costs to open and close the garage door—it’s just silly.

Hardware wallets are the most secure storage solution

Overall, hardware wallets are the most secure storage solution for blockchain-based assets at this point in time. There’s literally nothing better.

Even the most elite collectors like Gary Vee, Matt Kalish, and Kevin Rose who own millions of dollars worth of crypto and NFTs use hardware wallets to store their collectibles.

If your goal is to be on the same level as these guys, you must take wallet security seriously. Otherwise, all your hard-earned assets could be gone in the blink of an eye—literally.

Hardware Wallet Cons

I’d be lying if I said hardware wallets didn’t have some downsides. Here are some cons to using a hardware wallet.

Not everyone can afford a hardware wallet

Considering the cost of a hardware wallet, not everyone can afford one. That’s why many collectors and investors turn to free software wallets like MetaMask and Coinbase.

However, if you have the money to buy $79 worth of assets then you should be able to fork over an extra $80 for a cold-storage wallet.

If you can afford to buy assets but you can’t afford a proper storage solution, then I recommend you stop buying assets altogether until you’re able to purchase a hardware wallet. They might not be cheap—but they’re necessary.

Physical wallets are more difficult to use

Hardware wallets come with a slight learning curve before you’re able to use them. First, you have to charge it, set it up, then connect it to your computer to download certain applications depending on your specific needs.

Overall, the process requires more technical know-how to set up and get started. For someone who’s just getting into the space, it could be slightly overwhelming.

They’re not as convenient as software wallets

Software wallets are so widely used and accepted in the crypto space because of how easy they are to use. You simply install the app, create your wallet, and you’re good to go.

A hardware wallet on the other hand is not as convenient. Unlike software wallets, you have to order your wallet from a trusted seller and wait for it to ship to your residence before you can set it up.

Hence if you’re in a hurry a hardware wallet will require more patience. Not only to set up but also to receive it.

This is especially true if you order a wallet like Ledger which ships from France. If you live in the US, it could take up to 14 days to receive your device.

Not all hardware wallets are made the same

It’s true. Not all hardware wallets are made the same. There are only two notable brands I’d trust with my assets or even recommend to others such as yourself—Ledger and Trezor.

Although there are other options available, they either lack reputation or innovation. The wallets that do have a reputation are very limited in what they can store as they’re used for one specific blockchain and coin, like Bitcoin.

As a result, consumers remain limited as to what they can purchase. Fortunately, both brands have upheld their solid reputation making either option a no-brainer.

They don’t last forever

Such as any device, hardware wallets don’t last forever. Ledger wallets are created to last anywhere from 3 to 5 years. It’s not that they’re made cheap, it’s just that the battery (like iPhones) only lasts so long.

And Ledger doesn’t provide a battery replacement service, which means you’re stuck buying a new wallet every few years.

Not only can this get expensive, but it can be annoying especially because the average person probably doesn’t use their hardware wallet enough to justify buying one every so often.

Ahhh. The price we pay for security and peace of mind.

You could still get hacked

I know a majority of the “pros” section talks about how secure a hardware wallet is, but that doesn’t mean you can’t still be hacked.

Now, don’t get me wrong. If you use a hardware wallet correctly (solely to store your digital goods) the likelihood of it being compromised is basically slim to none.

However, if you’re using your hardware wallet to make transactions, stake, and connect to every website possible, you’re still likely to get scammed. Most scams are the result of the user (that’s us) granting access to the scammer.

When you connect your wallet to any decentralized app (dapp), you are verifying that you trust the website and approve of the connection. But, if you accidentally sign over your wallet’s access to a scammer—it’s game over.

Is A Hardware Wallet Really Necessary?

After looking over the above list of pros and cons, you might still be on the fence about whether a hardware wallet is right for you. Although I believe it’s worth every penny, it’s not for everyone.

I’m going to help you decide once and for all if a hardware wallet is really necessary for your personal situation.

A hardware wallet is necessary if:

- You have digital assets valued at over $79.

- You plan to buy even more digital assets.

- You plan on storing your assets for a period of time.

- You don’t have assets but plan to own more than $79 worth soon.

A hardware wallet isn’t necessary if:

- You don’t own any digital assets.

- Your assets are valued at less than $79.

- You plan on selling all your assets that are worth less than $79 soon.

Ultimately, the choice to get a hardware wallet remains yours. However, taking all the above into consideration, I hope you see the value in using one to securely store your assets especially if they’re valued at over $79.

That said, if you’re planning to buy a hardware wallet I highly recommend Ledger as it’s the most affordable and arguably the most trusted option.

Remember, don’t just buy a wallet from anywhere though. You should only buy it directly from the manufacturer or one of Ledger’s approved resellers.

Buy it from anywhere else and you risk buying a fake or compromised device.

If you’re still having a tough time deciding if you should get one of these devices, make sure to check out these other extremely helpful resources.

2 thoughts on “Should I Get A Hardware Wallet? (Cold-Storage Pros & Cons)”

Comments are closed.