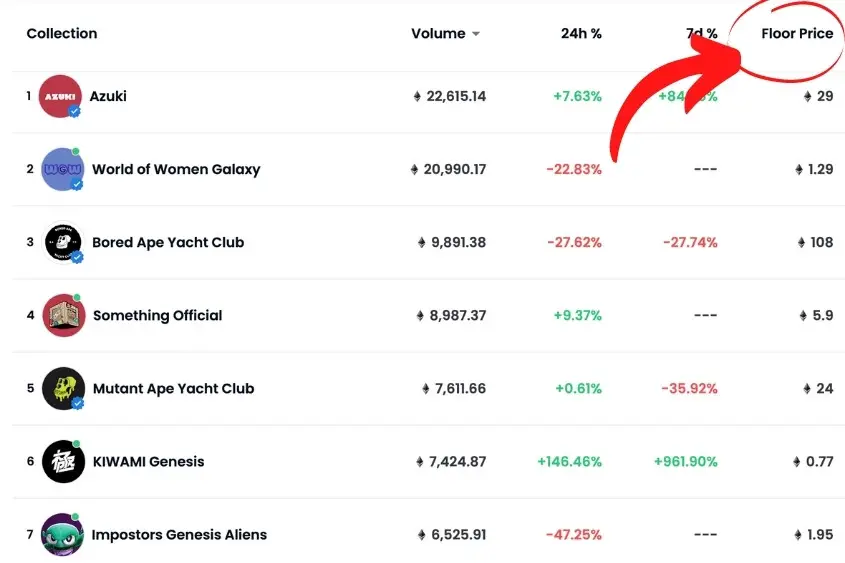

When most of us join the NFT space looking to buy our first NFT, one of the first things we are told to look at is the NFT floor price.

NFT floor price is the lowest amount of money you can spend to own an NFT or become a holder of a project. NFT floor prices are set by the creator at mint, and then by the market once the NFT reaches secondary marketplaces.

Below you will find everything you need to know about NFT floor prices and how to utilize this pricing structure.

What Is NFT Floor Price?

NFT floor price is the lowest amount of money you can spend to own an NFT or become a holder of a project. A price floor also represents the lowest value for an NFT in a market. Similarly to buying a product on Amazon or eBay, an NFT’s floor price is the lowest possible price you can purchase an NFT for.

Initially, the floor price of an NFT is set upon mint by the creator or company of an NFT project. Then, as consumers buy the NFTs, they are listed on secondary marketplaces at a new floor price.

Generally, people try to list their NFTs at a higher floor price on secondary than what they minted it for to make a profit. However, some people become impatient and end up listing their NFT lower than the initial mint price to free up liquidity.

Below are the different types of floor pricing you will find in the NFT market and what it might mean as a buyer:

Real-time value

The lowest price set for any NFT is the floor price. Real-time updates on prices take place in the market. This means that prices continually change from time to time, depending on the current market value.

The real-time value is generally what people base their buying and selling decisions on. Of course, real-time floor prices are always fluctuating either up or down, and for various reasons.

Decreasing floor price

When an NFT’s floor price decreases, it is not necessarily a bad thing and is considered to be quite common. There are many factors that go into determining an NFT’s value, and these factors change by the minute. Factors can include things like new developments in the project, new holders, and added utilities.

If you are part of an NFT project and the floor drops, there is no need to panic. Take your time to research why the project is decreasing in value. If you find that something negative has occurred and people are hesitant to keep their money invested, consider selling your NFT before it becomes completely worthless.

However, if there aren’t any indicators that an NFT project has done something to negatively affect its’ brand, then the more likely reason is that people are impatient, and are probably pulling their money to go invest in other projects, these people are known as paper hands.

Increasing floor price

If an NFT’s floor price is on the rise, this can be a good thing for many reasons, but not always. Similar to when a floor price is decreasing, an increase in floor price might be the result of new developments in the project, or it can be an artificial pump in the hype, in an attempt to get more people to buy into the project.

If you notice an NFT’s price pumping, don’t buy into it immediately. Again, take your time to research why it is pumping. Ensure that whatever is the cause of the rise in price is sustainable and not just a quick hype, unless you are planning to flip the NFT instantly for a profit.

Also, an increase in price isn’t always the best time to buy an NFT because you are paying more. Generally, when the price dips is when you would want to buy into a project, assuming the price dip isn’t the result of something negative that occurred.

How Is NFT Floor Price Calculated?

With all the fluctuations that occur in the NFT market, you might be curious to know exactly why there are so many ups and downs, and what actually determines an NFT’s floor price.

There are many factors that play a role in how a floor price is calculated, including:

Demand for the NFT

Demand for an NFT is an obvious factor when determining an NFT’s floor price. The more demand there is for an NFT, the higher the floor price will be. If there is minimal demand, expect the market to set the price lower.

Serial entrepreneur and Web3 innovator, Gary Vee, has made many comments about supply and demand in the NFT market. Focus on demand before you ever worry about supply, that goes for both buyers and sellers.

NFT’s utility or offering

Many NFTs in the early market provide little to no actual value to holders, and as a result, the floor price has gone down over time. However, people that have used NFTs to build successful brands and provide real value and utility to their holders, ultimately experience a higher floor price than NFTs with no value being offered.

That is why it is so important to ask yourself why you are buying an NFT in the first place. Does it provide you some sort of value or real-world utility? Or are you buying it because of the hype?

Both may be right, but it really depends on your goals, experience, and ability to move quickly and execute based on your personal reasons for buying an NFT in the first place.

Reputation of the brand/creator

When someone who is well known in the market releases an NFT, it can have a higher floor price. This is simply because the trust between the creator and community has already been fostered, versus someone new to the market who is largely unknown and has to gain the trust.

That’s not to say that all well-known brands and creators will offer NFTs at a premium floor price, rather, they could if they really wanted to.

Collaborations

When it comes to collaborations, the NFT essentially has double the value. For example, if Beeple and XCopy—two well-respected artists in the NFT space—come out with a collaboration piece, you could expect the floor price to start even higher, and maintain a hefty price on secondary markets because of their reputation and popularity.

Pros and Cons of NFT Floor Price

Buying NFTs at their floor price come with both pros and cons, let’s take a look at each.

Pros:

Buy at the cheapest price

With the floor price being the lowest value, it means that the NFT is being obtained at its cheapest. This can later be sold off for a higher price, with ownership being transferred to the new buyer.

Potential to flip NFTs for a profit

Flipping NFTs refers to buying cheap and selling high. Many buyers would initially purchase items at their lowest possible price and keep them for an extended period of time. When the NFT sells out of their initial drop, these buyers become sellers, letting go of the item for a much higher price than that at which it was purchased.

Cons:

Fall in prices

The floor price could fall further after an NFT project sells out. This indicates that there is a high chance you could have bought the NFT for a far lower price. It also indicates that if you are looking to let the item go, you’ll now have to sell it at a loss.

Unnecessary purchases

Buyers should consider spending more for higher-valued NFTS rather than those at a lower floor price. It will keep them from not waiting for the item to mature and be of higher value in the future. Of course, this all comes down to doing the proper research before buying an NFT.

What Is an NFT Floor Sweep?

An NFT floor sweep is when a buyer purchases all of the NFTs in a project at its lowest price. Buyers can then sell these NFTs at the new floor price and earn a quick profit. Someone may choose to clear the floor because of the NFT picking up momentum or a spike in its initial value.

Generally floor sweeps are carried out by “whales”, which is just an industry term for people who have a lot of extra money to spend.

Final thoughts

Ultimately, the NFT floor price is the lowest price you can obtain an NFT for at its current market value. Of course, there are many factors that affect the floor price of an NFT such as developments in a project, new buyers, and artificial hype.

That is why it is so important to always do your own research before purchasing an NFT, even at its floor price.

6 thoughts on “What Is NFT Floor Price? Everything You Need to Know”

Comments are closed.