Radix DLT is quickly becoming the new Ethereum. It’s a contender that is revolutionizing the way blockchains and decentralized apps are developed and maintained. There’s a lot to know about it. For starters, what exactly is Radix DLT?

Radix DLT is a digital ledger that accounts for all decentralized asset-related transactions. It is also a place for programmers and developers to assist in creating rules for how blockchain services operate in exchange for cryptocurrency compensation.

That being said, there’s a lot to learn about this Defi protocol. Keep reading to find out in more detail how Radix works and why it’s the developing platform you want to use.

Basics of Radix DLT

Radix DLT is a layer-1 decentralized finance protocol platform with a high processing output or throughput. Decentralized financial systems have to have financial services, such as loans and money transfers, in order to thrive. Radix allows developers to create decentralized finance protocols. These are critical for the services to work as intended.

Protocols are “rules” constructed from code created by developers in a “smart contract.” In order for the service to remain decentralized, it runs automatically, and once the rules are deployed, no one can control them. It’s platforms like Radix and Ethereum that allow you to trade, lend, buy, etc.

The “layer-1” part means that the code created is part of the fundamental infrastructure of the blockchain the platform is creating protocols for. Layer-1 is concerned with the primary networks, optimizing cross-shard synchronizing and allowing even multi-chain scalability.

The acronym DLT (Distributed Ledger Technology) simply means Radix records transactions and other financial details related to assets, like a traditional ledger, except that it’s all digital.

It’s systematically accomplished without the need for a centralized agency. Instead, the database is dispersed to several geographic locations among several “caretakers.”

How Does Radix DLT Work?

Radix is one of many ecosystems that are allowing assets by the billions to work together effectively. It has several features that allow it and its developers to function with ease, speed, and safety.

The Radix Engine

One of the problems with other similar platforms is hacked contracts. Smart contracts are automatically executed and their specifications are built into the code. Without solid coding and security, the contract can be hacked and the developer’s hard-earned money stolen.

The Radix Engine minimizes hacks by having the smart contract work with a “language” called Scrypto. Essentially, instead of using solidity which works like Javascript, Radix decompartmentalized their contracts for security.

The Radix Developer Royalties System

It’s actually the engine that fosters developer growth with provided easy-to-use building blocks and tools and with a decentralized developer incentivizing system. But the developers aren’t there to work for free.

In Radix, just like authors, developers receive royalties for their work. Radix’s developer royalty system (DRS) gives developers compensation for building smart contracts (A.K.A components) on Radix and improving the code.

It has the potential to create a completely autonomous decentralized marketplace.

The Cerberus Consensus Mechanism

“Cerberus” is the name of the consensus Radix uses. It’s a protocol that is specifically used for proof of work. In the case of a DLT, a proof of work designates the block mining process that counts transactions.

Cerberus is unsharded, but it still ensures all asset transitions are constructed over the course of multiple shards. It’s a means to fix blockchain’s scalability problem. Cerberus increases network nodes, which increases throughput.

Why Use Radix?

You should be paying more attention to DeFi in general since the apps, such as Uni Swap, are surpassing the transaction volumes of exchanges like Coinbase.

Radix, in particular, deserves careful consideration from you more than any other DLT because it has come up with solutions to so many common blockchain Dapp development problems, namely speed, scalability, and security.

Radix created a way to quickly and effectively allow developers to execute the contracts without the risks of either rushing to create the code, allowing bugs, or missing the market. Radix fixes these problems.

Besides, as a developer, Redix is the only platform that will allow you to build and program quickly, create frictionless scaling through Cerberus, and rewards you for helping to make it better.

Radix has unlimited scalability that doesn’t compromise its composability. It was designed to meet the financial needs of the $400 trillion global finance system. It never bottlenecks (congestion).

Lastly, you have a fully interconnected DeFi platform with a number of important applications. These include:

- Collateralized lending

- Decentralized exchanges

- DeFi insurance

- Money markets

- NFTs

- Stablecoins

- And much more.

What Are XRD Tokens?

Radix’s cryptocurrency, XRD or ERadix’s EXRD, are native tokens. A native token is any blockchain’s inherent digital currency that belongs to that chain. Ethereum, for example, has Ether (ETH) as its native token.

Holders of XRD have a “proof-of-stake.” It’s a token that all holders can use in order to participate in Radix’s proof of stake consensus mechanism, which we discussed in a previous section. EXRD tokens aren’t the same thing as the XRD tokens. EXRD is a placeholder for the ERC20 token on Ethereum that will inevitably be exchanged for the Mainnnet XRD token.

The XRD token is also what developers are rewarded with for their contributions to Radix’s protocols. This is good since the XRD token is the only accepted unit of exchange in Radix’s network for transactional fees.

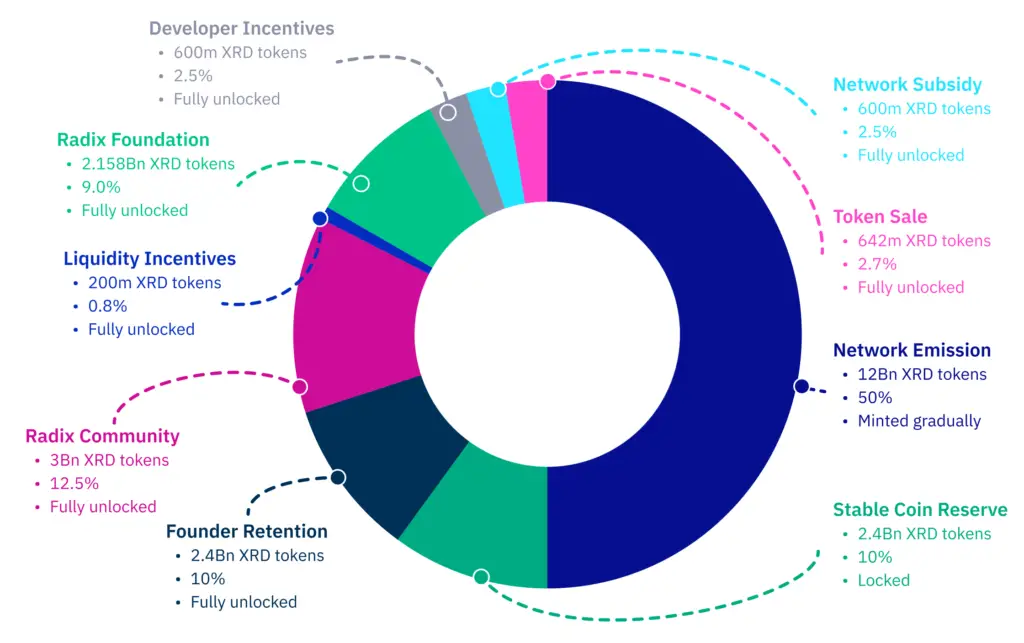

Radix put a cap on their XRD tokens to defend them against inflation. There are only 24 billion XRD tokens in existence, and not all of these tokens are available for developers and members.

10% is held by Radix itself to protect future development, another 10% is reserved for Radix’s stablecoins, and a little over 10% has gone to Radix’s non-profit organization, the Radix Foundation.

Don’t worry about the cap. The good news for members is that 50% of the 24 billion cap is reserved for is strictly for the staking emissions rewards. 24 billion is a large number and 300 million tokens are in circulation each year.

Conclusion

There’s no doubt that the world’s financial system is inefficient and slow. That’s why Radix DLT has created a digital ledger that accounts for all decentralized asset-related transactions and has made it easy for programmers and developers to assist in creating rules for how blockchain services operate in exchange for cryptocurrency compensation.

If you want to learn more about how Radix is paving the way for Defi transactions, make sure to check out their website.