It’s a well-known fact that some NFTs are known to be very expensive, especially if you are buying them from an individual or brand with a strong reputation such as Beeple or Bored Ape Yacht Club (BAYC).

But, what if you’re someone who really likes an expensive NFT such as Beeple or BAYC, but you can’t afford to pay the insane price tag associated with such in-demand assets? That’s where fractionalized NFTs (F-NFTs) can help you out.

The first time I heard of a fractionalized NFT I didn’t understand what it was or how it worked, but I knew that I wanted to learn more. That’s why I went down a rabbit hole for hours learning everything you need to know about F-NFTs and how they work.

Here is everything you need to know about fractionalized NFTs.

What is a fractionalized NFT?

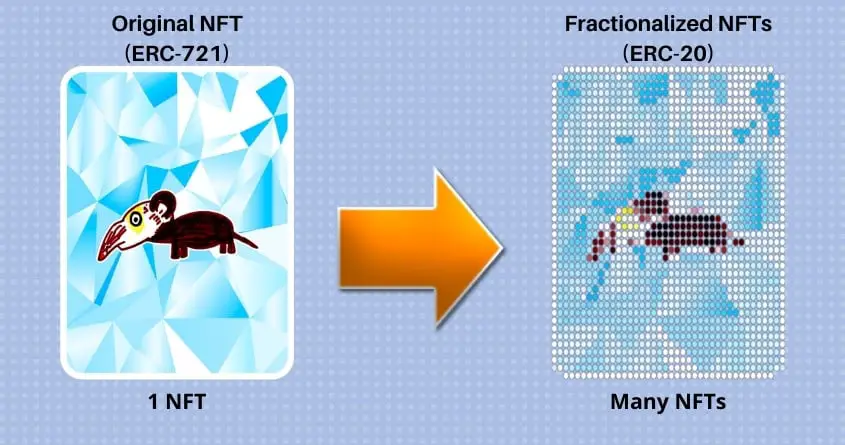

Fractionalized NFT (F-NFT) is an NFT that has been split into several individual tokens allowing for multiple people to have partial ownership over the entire NFT. This lowers the cost of investing in assets that would otherwise not be affordable.

An ERC-720 NFT (non-fungible token) on the Ethereum blockchain, for example, is broken down into several ERC-20 (fungible tokens) that can then be distributed to multiple people at a lower cost.

With that being said, let’s talk about how fractionalizing an NFT actually works.

How do fractionalized NFTs work?

Fractionalized NFTs work by deploying a smart contract to generate multiple ERC-20 tokens that are linked to an ERC-721 NFT. Meaning that several individuals can own a small portion of the NFT.

This fractionalization of digital tokens can take place on any blockchain that supports smart contracts and NFT technology. The NFT is secured in a smart contract on the blockchain and ownership of the NFT is represented by the ERC-20 tokens which are governed by the smart contract.

Fractionalized NFT pros

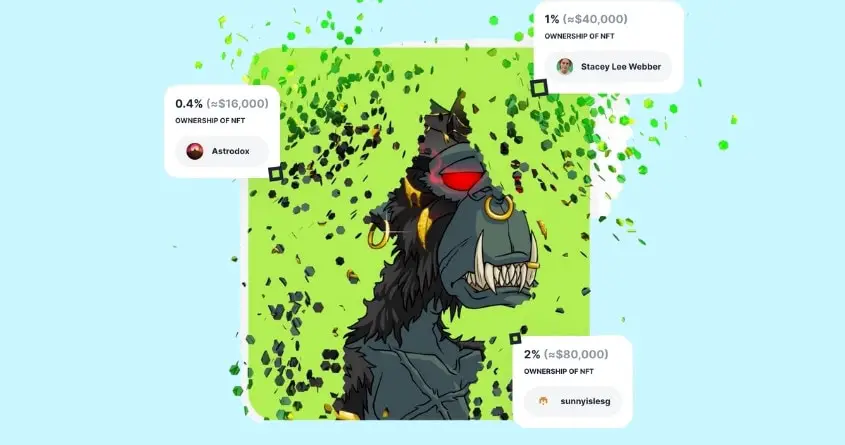

There are many benefits that come with the ability to fractionalize an NFT. An asset that is considered to be unattainable by most, is now made available to many by simply dividing a single NFT into several smaller portions that prove partial ownership. However, there are more pros to fractionalized NFTs, such as:

1. Lower barrier of entry

Breaking down something that’s extremely pricy into smaller more affordable tokens means that more people can purchase the NFTs they have always dreamt of collecting, without having to sacrifice their entire savings account.

2. More liquidity

A majority of the NFTs that holders choose to fractionalize are expensive, which means holders may end up waiting quite some time until someone puts in a large enough offer for the seller to accept, so it makes sense that they would want to divide their NFTs into smaller and more affordable shares. This fractionalization allows for more liquidity because you can sell pieces for a lower price as opposed to waiting for someone who can afford the entire NFT.

3. Increased investment opportunities

Nearly everyone who knows about NFTs is chomping at the bit to hold a highly sought-after asset, but unfortunately, many of us can’t afford the high price tag. So by dividing something expensive into something more affordable, there are more investment opportunities being made.

4. Integration of Defi

Staking, yield farming, and dexes are possible with fractional NFTs, effectively ERC-20 tokens (a standard for developing and issuing smart contracts on the Ethereum network).

5. Greater opportunity for a diverse community

When artists and brands gain a certain reputation and become highly desirable, it makes it difficult for the average person to invest in and support their creations. At the same time, the creator can’t just lower the price of their work as this could actually hurt their brand reputation. Hence, why fractionalizing an expensive NFT may be a better option.

As a creator, not only do you get to keep your brand reputation, but you also get to expand your consumer base and diversify the pot of people who are able to collect your creations.

Fractionalized NFT cons

Of course with pros comes a list of cons. Before considering having any part in a fractionalized NFT, make sure you’re aware of these cons.

1. Minimal regulation

As with the entire decentralized aspect of web3, the regulatory issue of fractional NFTs can be a legal grey area. This means that your investments are rarely safeguarded outside of the blockchain and are vulnerable to changes in the law and various attacks.

2. Cyberattack risk

Considering the entire fractionalization process is carried out through smart contract technology, the possibility of a cyberattack is possible. If there is an error on the smart contract, an experienced hacker could compromise the contract and expose everyone who’s a part of it.

3. The challenge for reconstitution

Reconstitution can be a problem when you only hold a fraction of an NFT. Things are simple if you hold a complete NFT. You own it outright and can sell it whenever you choose. If you own only part of an asset, however, you may not be able to use even a portion of that item. This means that the fractionalization platform must have a way to make the NFT complete again.

4. Auction buyouts

If you are someone considering fractionalizing your NFT, you should be aware of auction buyouts. Let’s say that you (the holder) fractionalize your NFT and sell 50 percent of it to a friend. Now you both own half of the NFT, but, if a third person comes and initiates an auction buyout, they get the entire NFT (both you and your friend’s portion), and you and your friend each receive 50 percent of the revenue.

As the original holder, you may end up losing money because half of it went to your friend after the auction buyout occurred. Of course, as the person fractionalizing the NFT, you should be sure that any auctions held will ensure a return on your initial investment.

5. Shared owner disputes

Fractionalizing an NFT means that you are willing to share a portion of your NFT with others, however, if you aren’t willing to share then you may want to reconsider this method.

The reason is that if you want to hold your portion of the NFT and wait for the highest possible offer, while your friend is willing to sell their half for whatever price they can get, this can cause a dispute if you can’t both come to an agreement on the pricing of your NFT and there happens to be a buyout auction mechanism.

This means your friend could potentially sell the entire fractionalized NFT at a price you’re not satisfied with causing a shared owner dispute.

Where to buy fractionalized NFTs

As NFTs continue to grow in popularity, especially since they are known as potentially profitable investments, there are many companies popping up that offer a fractionalization service for NFTs. Here are some of the most popular places to buy fractionalized NFTs.

1. Fractional.art

Fractional.art is a decentralized protocol where NFT owners can buy, sell, and mint tokenized fractional ownership of their NFTs. Fractional.art has some of the most popular NFT vaults to choose from containing some of the most iconic NFTs like CryptoPunks, BAYC, Cool Cats, and Artblocks, just to name a few.

2. Partybid.app

PartyBid is a platform that allows people to pool their money together to purchase NFTs collectively. You can either create your own party or join a party to bid together on certain NFT auctions and fixed-price listings.

You can use PartyBid to join parties that can target NFTs that are available on Zora, Foundation, OpenSea, Nouns, and Catalog.

3. Niftex dApp

Niftex is a decentralized app (dApp) that allows users to create and trade fractionalized NFTs. The NIFTEX Platform enables the division (“Launch”) of NFTs into fungible pieces conforming to the ERC20 standard. In order to access any of the features found on Niftex, you have to connect your web3 wallet. Currently, Niftex is undergoing some maintenance, make sure to check back for updates periodically.

Although these are some of the most well-known places for buying F-NFTs, there are many more platforms to come.

Final thoughts

Overall, NFTs are a huge opportunity for nearly everyone. Whether you’re a creator, a collector, or a strict investor, everyone has the chance to earn big by utilizing NFTs and their associated technology.

However, many of the iconic NFTs have already surpassed any amount of money that the average person can afford, and that’s why F-NFTs are so important. Fractionalization is a unique way to unlock NFT liquidity and community building around popular NFTs.

Moreover, the fractionalization of NFTs encourages accessibility, creativity, diversity, and freedom by lowering the barrier of entry for everyone. What do you think? Would you buy a small portion of your favorite NFT?

4 thoughts on “Fractionalized NFTs (F-NFTs): Everything You Need to Know”

Comments are closed.