In Web3, there are numerous blockchains that operate independently. The problem is that these blockchains lack interoperability. As a solution, these networks use bridges that sacrifice security, decentralization, and scalability. The Analog Protocol aims to solve this issue.

Analog is the world’s first layer-0 blockchain that uses proof-of-time to solve interoperability between blockchains. Hence, eliminating the need for bridges, oracles, or sidechains. Analog is compatible with all existing blockchains and allows for entire blockchains to be built upon it.

Considering Analog aims to solve a huge issue within the Web3 space, there is a lot to discuss when it comes to this layer-0 protocol.

What Is the Analog Blockchain?

Known as the blockchain of blockchains, Analog is the world’s first true layer-0 blockchain that utilizes a proof-of-time (PoT) consensus mechanism. Analog is aiming to create a timegraph in an attempt to unleash the potential of time.

Tesseracts and time nodes are at the heart of the platform, allowing various ecosystems to speak the same language by privately fetching and confirming event data from sovereign chains.

Analog’s omnichain network allows decentralized applications to communicate effortlessly through validated event data. For example, this means you can swap from SOL on Solana to AVAX on Avalanche via a single transaction on the source chain

As a result, current and new dApps can expand beyond the walls of Ethereum Virtual Machine (EVM)-compatible chains.

Analog’s superfast PoT protocol creates verifiable event data on the Timechain, allowing dApp developers to build next-generation cross-chain applications such as multi-chain decentralized exchanges (DEXs), multi-chain yield aggregators, and non-fungible token (NFT) swaps.

Builders can plug in their chains to all other networks. DApp developers can host their applications on any chain and communicate with different ecosystems, while users can directly interact with all dApps from their Analog wallets.

I know what you’re thinking. What does all of that mean? Allow me to break these terms down into something more digestible.

What exactly is event data?

Event data, as defined by Analog blockchain, is any data that subscribers desire to measure and its related qualities. Real-world events like as supply chain tracking data, dApp operations such as purchasing a token and moving it between wallets, and sophisticated activities such as staking cryptos in numerous liquidity pools are examples of these.

Any activity on or off-chain should ideally result in events that can be time-stamped and their properties recognized. Because it merges blockchain with real-world legacy networks, a Layer-0 blockchain is sometimes referred to as the data transfer layer.

Analog does this by the use of the tesseract time node, which collects event data from external networks, smoothly integrating the real world to the blockchain.

Layer-0

Layer-0 is the beginning phase of a blockchain that allows networks like Bitcoin and Ethereum to function. It’s made up of protocols, connections, hardware, and miners. In other words, it is the underlying infrastructure of a blockchain network.

Essentially, it’s the base layer protocol upon which other layer-1 chains (Ethereum, Terra, Bitcoin, etc.) or layer-2 protocols such as Polygon and Uniswap can run. The Analog network is a layer-0 network because it provides low-level primitives (routing and consensus) for cross-chain communications.

Proof-of-Time (PoT)

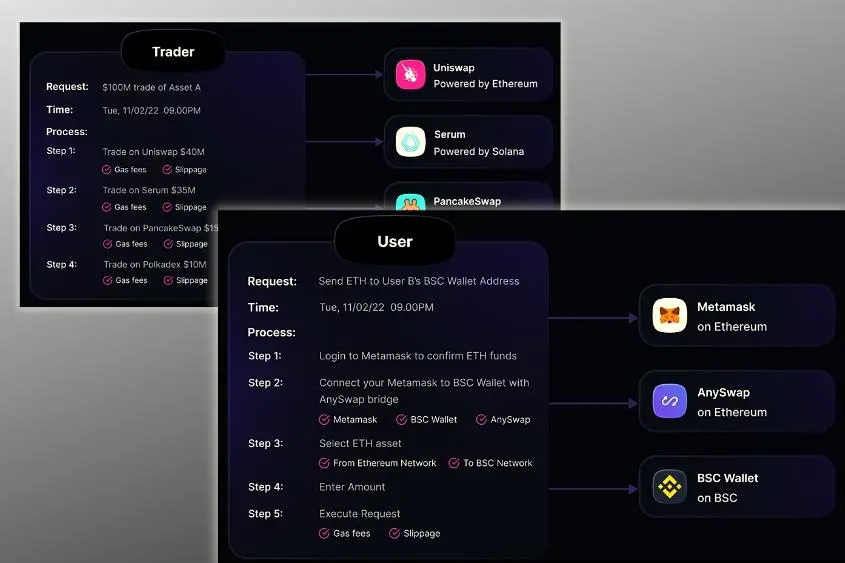

According to Analog, PoT is an environmentally sustainable, verifiably secure, and scalable consensus algorithm that validates event data on the Analog network.

How does it work?

Proof-of-time is a consensus mechanism where the value of time is protected and validated. Time is expressed by tokens, and the only way to mint tokens is to spend time. It combines a ranking score and staked a minimum number of $ANLOG tokens to determine which node proposes and confirms the next block.

Omnichain

Omnichain is a shared infrastructure where all chains can interact bi-directionally, allowing them to frictionlessly transfer value.

How Does Analog Work?

To enable omnichain interoperability, Analog employs proof-of-time (PoT) consensus, threshold cryptography, zero-knowledge proofs (ZKPs), and smart contracts. Any node may join the network as a tesseract node (a specific time node that retrieves event data from external chains) and participate in cross-chain event data transmission using Analog’s SDK platform.

When a tesseract node is activated, it listens for event data on external chains and transfers it to the Analog network through RPC endpoints.

To broadcast event data to the Analog network, a threshold signature from a supermajority of tesseract nodes is necessary. The fetched event is validated and confirmed to the Timechain when it is delivered to the network using PoT consensus.

The Timechain is a universal ledger made up of authenticated time data that verifies what happened in the past truly happened. DApps on target chains can then get verified event data and use it to trigger actions inside their smart contracts.

The Benefits of Analog Blockchain

There are many benefits to the Analog Protocol. Especially compared to traditional attempts of interoperability between chains.

- Decentralized interoperability with zero trust. Analog is entirely decentralized, in contrast to centralized bridges that limit which nodes may engage in interoperation. There are no restrictions on who can join as a tesseract. In that any node may participate, the consensus procedure is also transparent and equitable.

- Interoperability in record time. Proof-of-time (PoT) is scalable and extremely quick in contrast to proof-of-work (PoW) and proof-of-stake (PoS), which are often sluggish owing to protracted block waiting periods. To reduce confirmation delays, it makes use of a brand-new verified delay function. The network has increased throughput as a result.

- Offers a one-click user experience (UI). Analog provides a simple universal wallet that allows users to effortlessly access global liquidity with one click. Every cross-chain contact gets users closer to their interoperability goals while removing as many steps as feasible.

What Is $ANLOG

$ANLOG is Analog’s native currency that powers all the transactions. It is used to incentivize good actions by nodes and subscribers while penalizing deceptive entities on the network. Currently, $ANLOG is minted as ERC-20/BEP-20.

However, once the mainnet goes live, a re-mint will take place to provide an interface to allow existing token holders to transition to the new tokenomics system.

Below is a table summarizing the token specifications:

| Feature | Specification |

| Token standard | ERC-20/BSC |

| Token name | ANALOG |

| Token Ticker | $ANLOG |

| Total token supply | 90,579,710 $ANLOG |

| Total vesting period | None |

| Mintable? | Yes |

| Burnable? | Yes |

| Pre-minted? | Yes |

13.8 billion $ANLOG tokens were issued at the start of the Analog network. The already produced tokens will be re-minted and burned when the mainnet begins, nevertheless. The maximum fixed and permanent supply of $ANLOG tokens is 90.58 million.

The distribution scheduling mechanism is highlighted in the table below:

| Stakeholder | Allocation | Percentage | Vesting |

|---|---|---|---|

| Team and advisors | 17,210,144.90 | 19.00 | 4 years |

| Treasury | 13,224,637.66 | 14.60 | Ongoing |

| Private sale | 24,275,362.28 | 26.80 | 2 years |

| Community allocations | 34,420,289.80 | 38.00 | Ongoing |

| Public sale | 1,449,275.36 | 1.60 | Ongoing |

| Total | 90,579,710.00 | 100 |

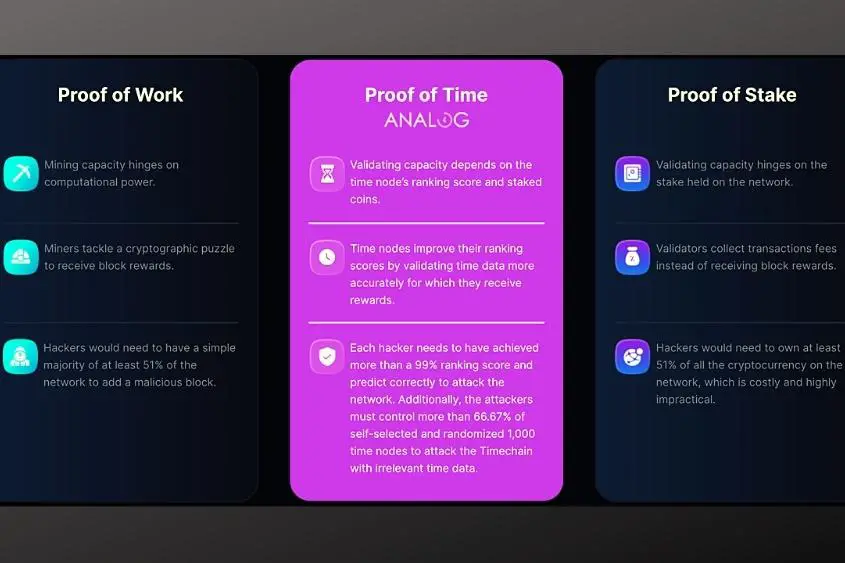

Below is a brief summary of how the network will distribute $ANLOG tokens:

- Public sale: This includes all the $ANLOG tokens offered during pre-launch sale or lock drop allocations open to public participation.

- Community allocations: This includes the ecosystem funds, staking rewards, or airdrops that will eventually go to the Analog community.

- Insiders: The $ANLOG tokens offered to insiders will comprise the Analog team, advisors/partners, and venture capitalists (VC).

- Treasury: The main objective of the treasury is to create the needed runway as opportunities arise. Analog has slated this for realizing partnerships, developer rewards, community grants, operating capital, exchange listings, strategic investments, and any investment that will ensure the long-term benefits of the project.

Analog Use Cases

Below are some common issues in the Web3 space, and how Analog aims to solve them.

Decentralized Finance (DeFi)

Just about all DeFi protocols run on either layer-1 or layer-2 chains. These chains hold distinct characteristics that limit cross-chain communications and liquidity fragmentation.

Leading dApps like Curve and Aave can only transact using tokens that are native to their underlying networks. This is a huge bottleneck that limits them from a majority of liquidity in non-native blockchains.

Dex trading

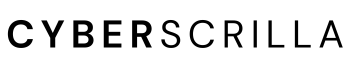

Most decentralized exchanges (DEXs), like centralized exchanges (CEXs), operate as order books, where users purchase and sell orders at their desired rates. The key distinction between CEXs and order book DEXs is that the latter keeps assets in users’ wallets rather than exchange wallets.

Depending on their designs, order book DEXs can be off-chain or on-chain. However, a DEX can become unstable and vulnerable to price fluctuations and slippages if there is insufficient liquidity to support the trade volumes.

This forces users to employ several DeFi protocols on separate chains to exchange tokens, which typically results in increased transaction costs and inconsistent user experiences.

The liquidity issue extends to automated market makers (AMMs)-based DEXs as well. Buyers and sellers do not deal directly in an AMM-driven DEX, but rather through a collective liquidity pool (LP) and algorithmic protocols. AMMs, on the other hand, leverage LPs from a single network rather than a single pool that offers liquidity for an asset to connected layer-1 chains.

Through the use of Analog, a timed, multi-chain order book DEX/AMM is made possible, allowing bids to be partially and securely completed across many LP networks. This ensures finality on the source chain and resolves the liquidity fragmentation issue without the need for centralized bridges or wrapped assets.

Lending and borrowing

To provide customers with loan and borrowing services in a trustless way, a number of decentralized money markets (DMMs) such as Aave and CREAM have arisen. DMMs typically work as decentralized node-managed on-chain smart contracts, rather than as centralized entities.

DMMs are appealing to consumers, however, they do not allow for smooth lending or borrowing between chains. Currently, a user who wants to borrow on BSC but owns tokens on Ethereum must first collateralize on Ethereum, bridge (at a cost), borrow on BSC, and then switch back to Ethereum (at a cost). Due to the several phases, this procedure is both time-consuming and expensive.

DMMs need real-time connectivity to other Blockchain ecosystems to prevent insolvency and maintain over-collateralization. Borrowers, for instance, may easily borrow on BSC using a one-click transaction if they have assets on Ethereum.

Cryptocurrency and Hedge Funds

According to Coinmarketcap.com, the market value of all cryptocurrencies worldwide increased from a meager $760 billion in 2017 to almost $1.75 trillion as of March 2022. The ability of cryptocurrencies to act as a hedge against the current state of the traditional economy is a major factor in the market capitalization boom.

The cryptocurrency markets offer both institutional and ordinary investors exciting options while being regarded as a very volatile industry.

This is due to the inherent characteristics of the Blockchain, such as its lack of reliance on intermediaries, security, and ability to conduct international transactions.

Nevertheless, despite these assurances, liquidity dispersion prevents hedge funds from taking advantage of the full potential of the bitcoin market. The cryptocurrency market now consists of several fragmented networks, each of which has untapped liquidity outside of its own ecosystem.

Hedge funds may use Analog’s time-based smart contracts to monitor each chain’s activity and streamline transactions across several networks. They may, for instance, use smart contract-enabled transactions to invest in several low-risk protocols all at once.

Yield Farming

The cryptocurrency community may benefit from their assets by earning incentives anytime they stake or lend them on Blockchain platforms thanks to DeFi-based yield farming. Users can get extra rewards in addition to new tokens when the value of an asset rises.

Since the majority of yield farming protocols currently in use are Ethereum-based, users are limited to working in walled liquidity environments. In addition to having a disjointed liquidity foundation, most protocols make inaccurate assumptions regarding time data, which is critical in today’s fast-paced, fiercely competitive environments.

For instance, it is difficult for market makers to choose whether to lock up their capital in liquidity pools to maximize annual percentage rates (APRs) or annual percentage yield (APYs).

Metaverse

The metaverse has matured into a disruptive ecosystem that offers new opportunities for creators, artists, and gamers by completely reinventing the digital assets market. The metaverse not only expands the web but also serves as its replacement as the main platform for work, play, and even e-commerce.

Cross-chain NFT Auctions

The main way that consumers can buy NFTs is through NFT auctions. NFT marketplaces like OpenSea enable users to communicate with one another to agree on the price of the NFT being auctioned rather than just choosing a digital asset and buying it.

The seller establishes a minimum price for the item during the auction for a defined time period. As long as their values are more than the minimum price, buyers may place a bid for the NFT for the period of the defined time. When the predetermined period has passed, the NFT is sold to the highest bidder.

According to Analog, a true metaverse enables users to effortlessly move their assets between other DApps and chains. Users may quickly combine several virtual worlds and have access to cross-chain NFT auction features by using a decentralized Timegraph.

Play-to-Earn Games

In the past, only content producers or e-sport competitors could make money from playing video games. However, players may now cultivate or gather NFTs and immediately sell them on the market thanks to play-to-earn (P2E) games with Blockchain support.

Players may transfer value and receive money regardless of who they are or where they are located since blockchain enables international transactions. Despite how appealing P2E games are, players cannot easily move NFTs like avatars or weapons made in one game to another or chain.

For instance, players who want to leave Fortnite are unable to transfer their hundreds of dollars worth of cosmetic purchases to another gaming ecosystem.

Thanks to Analog, gamers can now move their off-chain assets to on-chain networks. So now a player in Fortnite may get the Jinx skin and transfer it to the Sandbox or Decentraland.

Ultimately, Analog is the first layer-0 blockchain-powered by proof-of-time that aims to solve the interoperability problem between blockchains. So whether you’re a developer, an angel investor, or simply a blockchain-savvy individual, Analog has something for you.