As the NFT space continues to grow, so does the number of scammers. Even though many of the top NFT scams have been exposed to some degree, I still see collectors falling victim to scamsters every day! That said, I feel that it’s my responsibility to help put a stop to this problem once and for all.

Below I’ve listed the top scams in the NFT space that are absolutely wrecking collectors’ portfolios. By the end of this article, you’ll know all the major red flags to look for so you can avoid falling victim too.

What Are the Top NFT Scams?

There are numerous scams in the NFT space you need to be aware of if you plan to avoid them all. Here’s a quick video if you want to learn about these scams. Otherwise, keep reading below.

1. Bidding Scams

One of the most basic scams in the space is known as a bidding scam. Due to its simplistic nature, this type of scam is easy to fall for if you aren’t careful.

Scammers simply place a bid on an NFT you own using a currency of lesser value to make it appear as though they’re offering you a deal you can’t pass on.

For example, say you have an NFT you’re selling for 1 ETH. Except, rather than offering you ETH, the scammer offers you UDSC. However, the only problem is that USDC is worth much less than ETH.

In fact, it’s pegged to the US dollar. So, even though it looks as though someone is offering you even more money, such as 1.5 ETH, it’s actually USDC—which equates to $1.50.

Ouch!

Other types of crypto scammers might use to bid on your listing include DAI, SOL, BNB, and AVAX. All of which are worth much less than ETH.

2. Rug Pulls

I can’t express this tip enough. Doing your own research on any digital asset you are considering investing in is critical to ensure all your assets remain safe, including your currency.

One common scam found in the NFT space is known as a Rug Pull. A rug pull is a scam where developers build a bunch of hype around a product/brand—and then once liquidity flows into the project, they pull out the liquidity, leaving consumers empty-handed.

This exact scam has happened to me once before. The brand had great art, and a growing community, but almost no communication from the developers of the project. People quickly became aware of the lack of communication from the creators and went into panic mode.

One key sign to look for when investigating a potential investment is to look and verify that the creators of the project are completely open and honest about who they are as humans. If you find little or no information regarding the actual human being behind a project, someone who is willing to put their own reputation on the line, this should be a huge red flag.

Aside from rug pulls, there are various other scams to watch out for. Conducting your own research will give you the ability to make the best decision possible when considering your next digital investment opportunity.

If you are unsure of what to look for when researching an NFT brand to invest in, then take a look at my collector’s buying guide which will show you what I personally look for when I buy my own NFTs.

3. Phishing Links

Scammers love to take advantage of human nature. As humans, we sometimes misspell things—leading us to the wrong site. In the NFT world, these scam sites can be extremely dangerous.

Scammers have been known to create sites that are an exact replica of an authentic site, leaving unsuspecting victims susceptible to a cyber attack.

If scammers are able to get hold of your secret phrase, or even gain control of your desktop, they will be able to gain complete access to your wallet and all of the assets within.

Always double-check the URL to ensure the address you are visiting is correct, never enter your secret phrase—especially at the request of a site, and avoid doing anything you don’t feel absolutely comfortable doing. Keep in mind, if something seems too good to be true then it probably is.

4. Impersonators

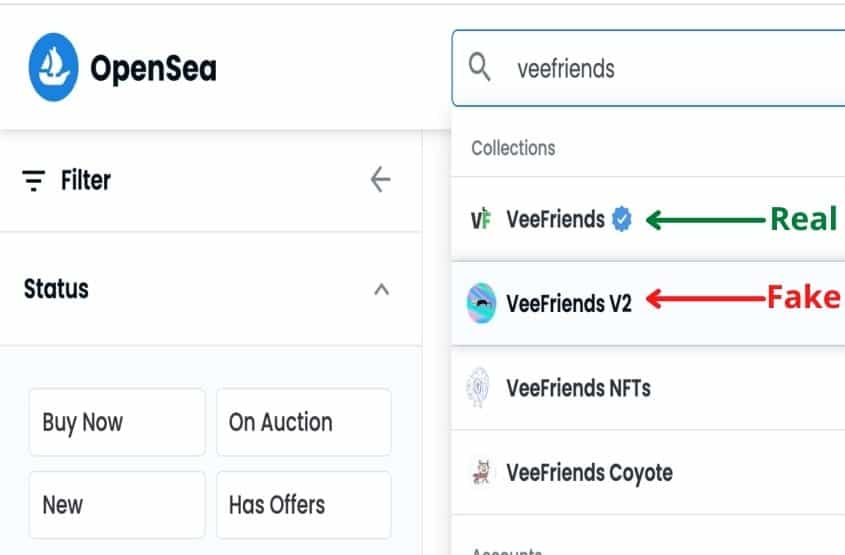

Brands and start-up companies are generally very active on social media. From Twitter to Discord, brands are all over online, which is why it is essential to know the exact brand name and logo when you are looking to buy an NFT from a specific brand. Usually, you are able to find a trustworthy link on the brand’s official social media accounts.

A common indication of brand impersonation is additional words or characters in the name. For example, scammers may add the words Official, Authentic, or even add a checkmark to make an account appear verified. If you are unsure of brand authenticity, reach out to the brand personally or someone you trust in the community.

Furthermore, brand impersonators are known to contact people through their DM on social media and other various platforms and act as customer support or community moderator. A brand should never directly contact you to ask you for your seed phrase, to send money, or any other request that may make you feel uncomfortable.

If you are unsure of the brand or any members of the brand reaching out to you, it’s best to just avoid them until you have time to do your own research and authenticate exactly who you are communicating with.

5. Malicious (Poisonous) Airdrops

We all know that airdrops can be a nice surprise. However, they can also be elusive scams that catch you off guard if you don’t know how to spot the one with bad intent.

Malicious airdrops, or as I like to call them, poisonous airdrops, are malicious NFTs that are sent to your wallet unexpectedly. By the way, the fact that it’s sent to you without your knowledge should be the first red flag.

These NFTs can seem harmless. But the moment you try to interact with them can wreak havoc on your wallet. Many malicious airdrops that appear in your wallet will already have a bid on them. This is the scammer’s attempt to try to get you to accept the offer.

But, when you go to accept it, an error message pops up insisting that you visit a link to resolve the issue. Don’t click the link! This is simply a phishing link that hackers will use to access your wallet.

Likewise, collectors might try to sell these NFTs on a marketplace thinking they can make a quick buck. Again, this will result in an error message that requires you to take action before you can sell it.

Obviously, you don’t want to click this link either.

So, what can you do?

All you can really do is report the NFT on a marketplace such as Opensea. Simply head to Opensea, search for the NFT that’s in your wallet, and report the individual NFT and the entire collection if applicable.

Eventually, Opensea will delist it and the poisonous NFT will disappear from your wallet.

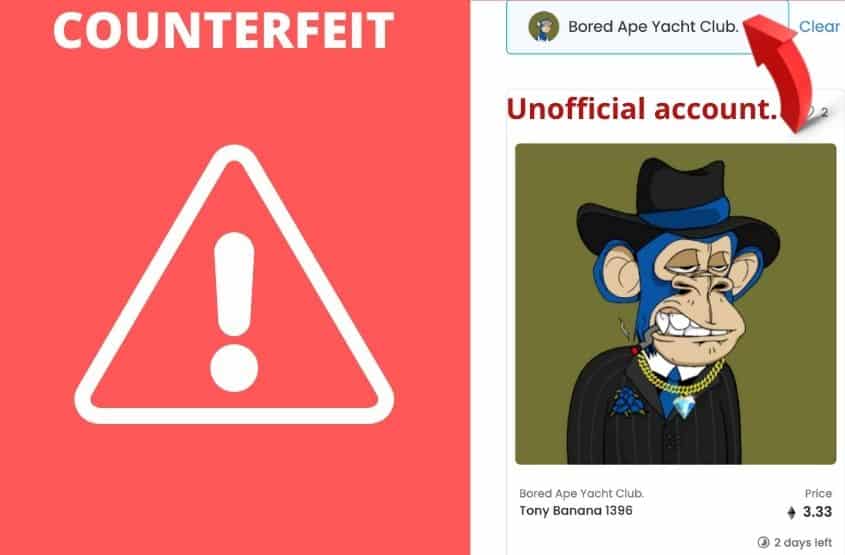

6. Counterfeit NFTs

Nobody likes a fake, especially when NFTs are supposed to be unique, irreplaceable, and non-interchangeable.

Counterfeit NFTs have been purchased by people who thought they were purchasing the real deal. One easy way to check for a replica is to look at the transaction data and check who minted it and when. Then you can compare this data to what you know about the NFT creator and ensure it is indeed authentic.

These replica NFTs generally look identical to the real thing but keep in mind, it’s all about the metadata and when the token was actually minted on the blockchain. Don’t verify authenticity simply by how an NFT looks.

7. Wash Trading

The classic wash trading scheme (aka pump-and-dump) is one of the most misleading plots in the NFT space. A pump and dump is when a person or group of people purchase a large number of digital assets in order to drive the demand and the price of an asset up.

Once the pump increases the value and liquidity, scammers dump all their assets for a nice profit.

One of the easiest ways to detect a pump-and-dump scheme is to study the transaction history of an NFT. It is common to see a nice and steady rise in value with a diverse group of buyers, depending on the number of assets available.

If you happen to see the same two or three people buying and re-selling for a higher price, this could be an indication of a pump-and-dump scheme.

If you find yourself in a pump-and-dump project, it is best to get out as quickly as you can—and hopefully without losing any of your money. An even easier way to avoid losing money due to a pump-and-dump scheme is to avoid the situation entirely by doing your own research. Sorry, I had to say it.

How Common Are NFT Scams?

One of my main concerns when I first began buying my own NFTs was the possibility of getting scammed out of my hard-earned money. But then I thought to myself, how common are NFT scams, and should I really be that worried?

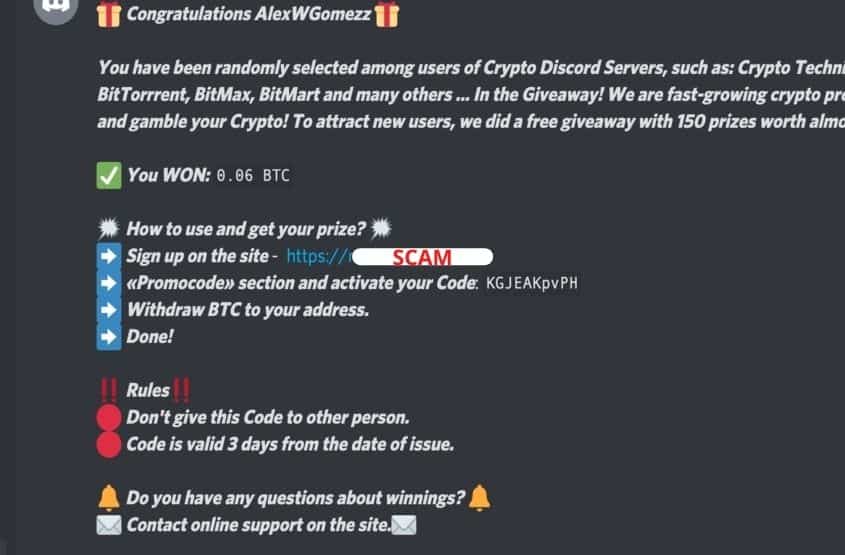

NFT scams occur on a daily basis multiple times per day and on various platforms. Discord, social media, and other online platforms are lurking with scammers who are waiting to take advantage of you. The best way to avoid NFT scams is to get educated on the types of scams so you can avoid them.

Personally, I have been scammed one time which was a rug pull incident. And although still a scam, at least I did receive a number of NFTs out of the deal. However, I still encounter multiple scam messages on Discord and some of my social media accounts on a weekly basis. My point is, scams are not to be taken lightly. They are out there and people fall for them every day.

If you have important digital assets you wish to keep safe, I highly recommend storing your NFTs in a more secure wallet that is less likely to be hacked.

To learn more about how I keep my assets safe, check out Securely Storing Your NFTs: A Complete Guide.

Overall, it comes down to being aware of what scams are out there. Do your research, don’t do anything that makes you uncomfortable, and if you find yourself in an uncomfortable situation get out of there as fast as you possibly can. Remember, you are in control. Don’t be fooled by these scammers.

How to Avoid NFT Scams

Don’t get greedy

In my experience, being greedy is the quickest way to lose everything you have. Greed comes in many forms, but in the NFT space, there are a great number of greedy folks looking to make the quickest buck possible.

Being greedy when buying and selling NFTs can easily backfire if you aren’t careful. Here are some of the most common ways people get greedy with digital assets:

- Buying too much of one digital asset.

Purchasing a large amount of the same asset can be extremely risky. If the price of your investment plummets to zero, you may be left with nothing of value. This can be a devastating experience for anyone. - Trying to attain something that’s too good to be true.

If you ever receive a message saying you’ve won something and all you need to do is send some currency for the transaction, avoid this at all costs. Some people have a hard time passing up a good deal, but some deals aren’t as great as they appear to be.

Although these are only a couple of examples of greed when dealing with non-fungibles, they are very real scenarios that could end very badly. I say keep the greed to a minimum and help others stay aware instead.

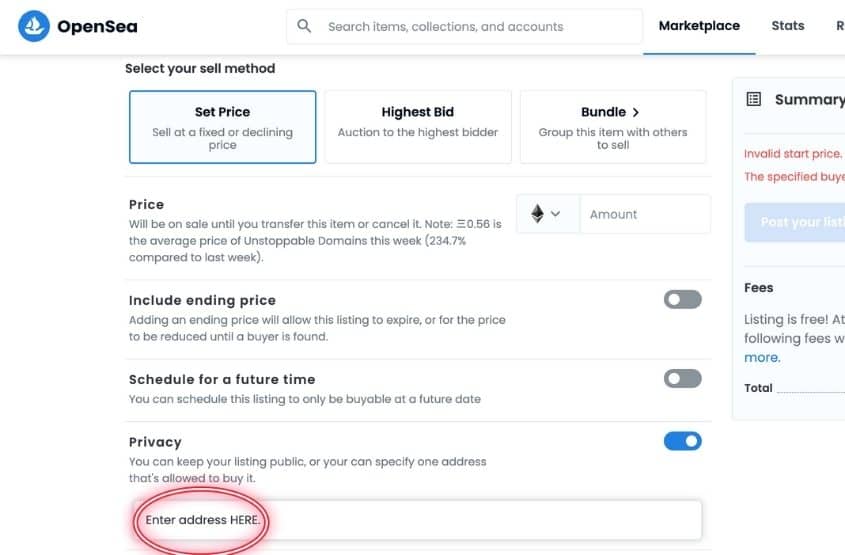

Only transact with people you trust

Make sure you only transact with people you know and trust on a personal basis. Transacting with an untrustworthy person can end badly.

Say you send someone your digital asset with the promise of payment upon delivery of the said asset, but instead the person doesn’t pay you and keeps your NFT.

It’s like taking candy from a baby, it is literally that easy if you are unaware of this type of scam. If you are looking to buy or sell one of your NFTs it’s best to use a secondary marketplace such as OpenSea.io.

When you sell an NFT on OpenSea, you have the ability to keep the sale private and specify one address that is allowed to purchase it.

Allowing the marketplace to be your trust when transacting with a stranger is one of the best options in my humble opinion. This way, there is no confusion on pricing, gas fees, and who is getting what.

14 thoughts on “Top NFT Scams Collectors Are Still Falling For in 2023”

Comments are closed.