If you’re trying to determine the value of an NFT, one of the first metrics you’re going to check is the floor price. So, what is the NFT floor price?

NFT floor price is the lowest ‘Buy Now’ price of a token in a specific collection. For example, if the floor price is 1 ETH, the cheapest you can buy an NFT from that collection is 1 ETH. The floor price doesn’t take into account the lowest bid price.

Below you’ll learn more about NFT floor price, how it’s calculated, the pros and cons of buying the floor price, and more.

Table of Contents

NFT Floor Price Explained

Notably, an NFT’s floor price is separate from its mint price. The mint price is how much it initially costs to buy an NFT. The floor price is developed on the secondary market and as a result, is determined by the market, not the creator.

Right after an NFT is minted, the floor price is generally higher than the mint price as people are trying to flip them for a profit. That said, it’s not uncommon for the floor price to increase significantly post-mint, followed by a sharp decline sometime after.

It’s fair to say that an NFT’s floor price is a direct indicator of how the current market values a specific NFT or collection.

Below are different floor price scenarios that you should be aware of.

Current floor price

The current floor price is generally what people base their buying and selling decisions on. Of course, real-time floor prices are always fluctuating for various reasons and can change by the second.

Declining floor price

There are several reasons an NFT’s floor price might decrease.

- The NFT is a scam (rug pull)

- The brand made a decision that collectors don’t agree with

- The token’s utility expired or has been claimed

- There are no new developments or the project has gone static

It’s important to research why an NFT’s floor price is decreasing. If you find that something negative has occurred and holders are hesitant to keep their money invested, consider selling yours before it becomes completely worthless.

However, if there aren’t any indicators that an NFT project has done something to negatively affect the brand, the more likely reason is that people are impatient, and are probably pulling their money to go invest in other projects. These people are referred to as “paper hands”.

Increasing floor price

If an NFT’s floor price is on the rise, this can be a good thing for many reasons. Some of these reasons could be:

- The brand has announced a new development or partnership

- The additional utility has been added to the NFT

- The brand has done a good job marketing and driving awareness to the collection

That said, an increased floor price isn’t always a good sign. If you notice an NFT’s price pumping, don’t buy into it immediately.

Again, take time to research why it is pumping. Ensure that whatever caused the increase is sustainable and not just a quick hype, unless you’re planning to flip your NFT instantly for a profit.

Moreover, an increase in price isn’t always the best time to buy an NFT since you’re paying more.

Generally, when the floor price dips is when you‘d would want to buy into a project—assuming the price dip isn’t the result of something negative that occurred.

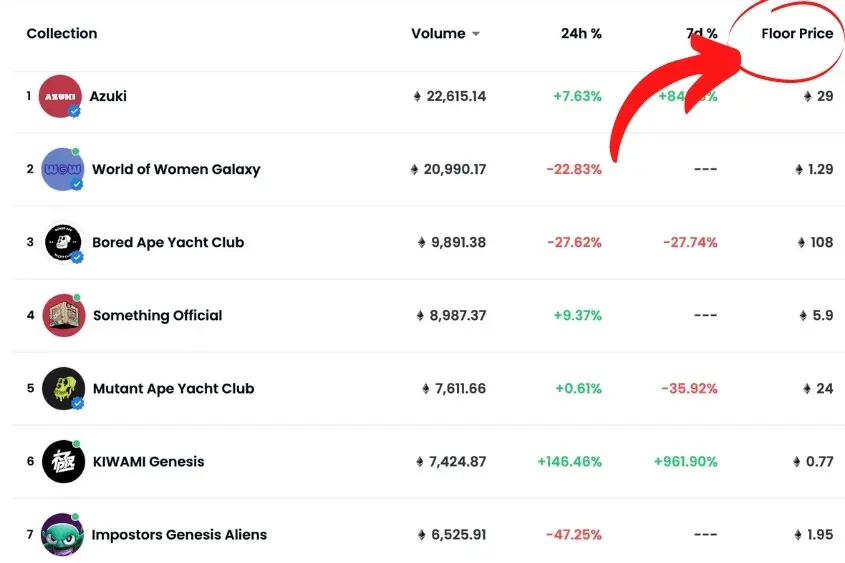

How Is NFT Floor Price Calculated?

NFT floor price is calculated by the holders. Whoever lists their NFT for the lowest price sets the floor. Collectors can change the floor price by buying an NFT from the floor. A common tactic to raise the floor price is called a floor sweep—where someone buys multiple NFTs to increase the floor.

As for how the floor price is determined, there are several factors that play a role.

Demand for the NFT

Demand for an NFT is an obvious factor when determining an NFT’s floor price. The more demand there is for an NFT, the higher the floor price will be. If there is minimal demand, expect the market to set the price lower.

Serial entrepreneur and Web3 innovator, Gary Vee, has made many comments about supply and demand in the NFT market. Focus on demand before you ever worry about supply, that goes for both buyers and sellers.

NFT’s utility/value

Many NFTs in the early market provide little to no actual value to holders, and as a result, the floor price decreases over time. Creators that use NFTs to provide real value and utility to their holders ultimately experience a higher floor price than NFTs that offer no value.

That’s why it is so important to ask yourself why you’re buying an NFT in the first place. Does it provide you with some sort of value or real-world utility? Or are you buying it because of the hype?

Reputation of the brand/creator

When someone that is well-known releases an NFT, it tends to have a higher floor price. This is because the trust between the creator and community has already been created, versus someone new to the market who is largely unknown and has to gain trust.

That’s not to say that all well-known brands and creators NFTs’ maintain a premium floor price.

Collaborations

Collaborations are a legit reason for an NFT’s floor price to be high. For example, if Beeple and XCopy—two well-respected artists in the NFT space—come out with a collaboration piece, you could expect the floor price to be higher and maintain a hefty price on secondary markets because of their reputation and popularity.

Pros and Cons of Buying NFTs at Floor Price

Buying NFTs at their floor price come with both pros and cons, let’s take a look at each.

Pros

- You’re buying it at the cheapest price

Since the floor price is the lowest amount of money you need to spend to get an NFT from a certain collection, you can rest easy knowing you’re getting the best “Buy Now” price possible.

Moreover, the floor price simplifies budgeting. By viewing the floor price you can quickly tell if an NFT is within your budget or not.

- Potential to flip NFTs for a profit

Depending on when you buy an NFT there’s always a potential to flip it for a profit. Generally right after an NFT collection sells out, the floor price will be lower, and can steadily increase from there. This means if you buy early enough you might be able to flip your assets for a profit thereafter.

Cons

- The floor price could still decrease

It’s possible that an NFT’s floor price will continue to decline, meaning you could have bought one for even cheaper. To avoid making this mistake, look at the analytics of the collection you’re considering purchasing before making any moves. This will give you a good idea of whether the price has been on the rise, is declining or has been steady.

- You could make a bid lower than the floor price

Although the floor price is the lowest “Buy Now” price, that doesn’t mean you can’t get an NFT for even cheaper. If you want to buy an NFT below its floor price, try placing a bid. More often than not, sellers are willing to accept a bid as long as it’s within 10-20% of the floor price.

What Is an NFT Floor Sweep?

A floor sweep is when a collector buys all the NFTs at the floor price. The aim of a sweep is to increase the floor and entice others to buy. Also, this could be a sign that a buyer has faith in a particular NFT collection and is taking advantage of the low price before it increases.

Oftentimes a floor sweep is done by a “whale”, which is industry jargon for people who have a lot of money to spend.

Frequently Asked Questions

Should I buy an NFT at floor price?

Yes, if you want a certain NFT the floor price is the most budget-friendly option. To avoid buying too high, check the collection’s analytics beforehand to see how the floor price has been holding up.

What does it mean when an NFT floor price drops?

If the floor price drops this could be a sign that the hype is wearing off or an unfavorable event has occurred leading collectors to believe an NFT is worth less.

Can you sell NFT under floor price?

Yes, if you list your NFT for less than the current floor price then your listing becomes the new floor price.

How do you know if the floor price of an NFT will go up?

If a brand announces something big such as a collaboration or added utility that brings more value to holders, you could see the floor price increase.

Where can I check NFT floor price?

Any NFT marketplace will display the floor price for a given collection. To view an NFT’s floor price across all marketplaces check out nftfloorprice.com.

7 thoughts on “What Is NFT Floor Price? Here’s Everything You Need to Know”

Comments are closed.