With the rise and fall of the NFT market, you might be wondering if NFTs are a bad investment, and if so, why? I’ve been investing thousands of dollars in NFTs since the beginning of 2021, so I have some first-hand experience when it comes to this exact topic.

Most NFTs are a bad investment because the market is new and volatile, which could lead to price fluctuations. Some NFTs may not have a strong resale value or may not sell at all. Buying and storing NFTs requires technical knowledge and infrastructure that may not be accessible to everyone.

Let’s take a closer look at why NFTs might not be the best investment for everyone.

Why Are NFTs A Bad Investment?

Most NFT projects and brands will fail because the creators aren’t capable of executing their roadmap properly in order to build a long-term and sustainable business. Many NFT projects are simply a quick cash grab with no real value or utility backing the digital asset.

Similar to the internet craze crash in 2000, a majority of NFTs and other various digital assets will come crashing down hard! And not just temporarily, but permanently. The problem with the NFT marketplace is that the supply currently outweighs demand, as does the lack of actual value and utility backing most NFTs.

As large corporations, brands, and innovators begin to explore NFTs and incorporate the technology themselves, many will begin to realize what a valuable NFT looks like in comparison to all the worthless NFTs currently flooding the markets.

What many modern-day NFT creators and investors fail to realize is the fact that NFTs are a technological platform that can be used to either build a brand from the ground up or add further value, trust, and transparency to existing brands.

Instead, many NFT creators have simply created nothing more than a picture with little to no actual value or utility at all. They aren’t building a brand, creating a strong intellectual property, or providing anything at all to their consumers besides the NFT itself.

Furthermore, many of the media headlines you see regarding NFTs, are stories about people making huge profits buying and selling NFTs. This tends to leave the impression that NFTs are either a get-rich-quick scam, or that any NFT can make you a million dollars, and both are simply untrue to a certain degree.

Here are some arguments against the longevity of NFTs respectably:

- NFTs are just a fad

- NFTs are simply JPEGs

- NFTs are a scam

- NFTs are not environmentally friendly

- NFTs are only for the rich

- NFT technology is slow and difficult to use for the average person

While many of these arguments are true to some degree, it’s not the case for every NFT. However, I do agree that a majority of NFTs are nothing more than a JPEG, many of them are scams, the technology is expensive and non-efficient, and the barrier of entry can be high depending on the blockchain used to transact.

BUT. That’s not the case for every NFT.

How to spot a bad NFT

Spotting a bad NFT project isn’t always simple, but there are signs to watch out for, such as:

- The creators of the project aren’t doxed (personal identity is hidden)

- Lack of community involvement or a negative outlook on the community

- Little to no consistency in their interactions on social media

- The creators show a lack of passion or conviction for their NFT brand

- No website or home base to find contact information, or info regarding the brand

- No customer support or lack of effort to help others

- Buying the floor to make it look like the value has increased

- Spamming people to buy into the project

- No execution or real value is being provided to consumers

- Lack of verification on NFT marketplaces

If you study enough bad NFT projects, you can develop a sense of whether a project has the potential to sustain a community and build a real brand, or if it will plummet. Ultimately you’re investing in the creator of the NFT brand, not the NFT itself.

Likewise, once you began understanding what makes a good NFT project, you will quickly be able to spot a bad investment, versus a potentially good NFT.

Beware that in a fast-growing and loosely regulated space, imitators and scammers pop up quickly. Platforms often have verified accounts for notable creators, which can help you choose a trustworthy NFT brand.

For lesser-known creators (whose NFTs are likely to be far more affordable), a good thing to do is research information such as what they’ve sold previously and how many of a given type of NFT they intend to make. If they haven’t set up an external website to provide information about their work and brand, for instance, that could be a red flag.

How Do NFTs Gain Value?

The value of an NFT is based on four primary factors; utility, history, brand recognition, and liquidity premium. Does the NFT offer something desirable, does it or will it have historical significance, are the creators building a brand, and can it be sold easily? Ultimately, the market always determines the value of the NFT.

NFT utility is how it is used such as a token used in gaming. High ownership values also play a role if the token is created by a famous person or brand name. The future value involves the speculation of where the NFT will move over time. Liquidity premium refers to how much demand there is for the NFT with NFTs with higher traffic yielding higher premiums.

How to Safely Invest in NFTs

The only way to safely invest your money in an NFT is to never spend more money than you can afford to lose. Also, always do your own research on the creator, and their reputation as a person and business builder, and don’t take anyone’s advice over your own intuitive skills.

Here are some steps to take if you are attempting to safely invest in NFTs:

1. Research any potential NFT investment

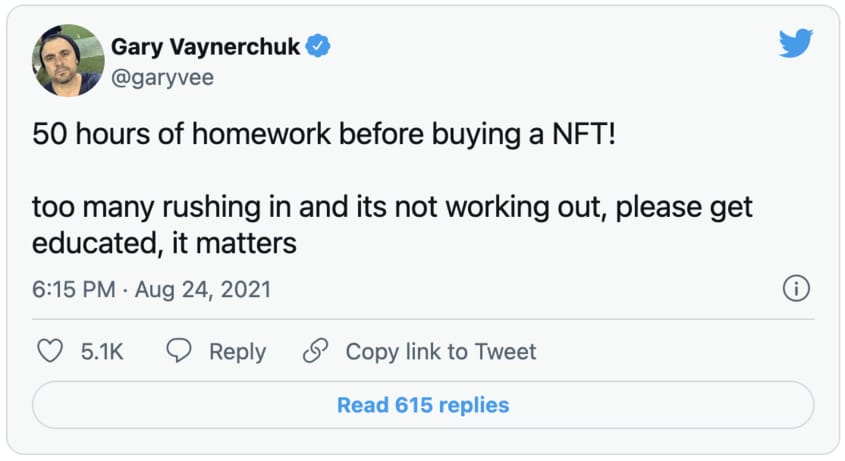

You’ll want to choose an NFT that you feel has an upside value potential. The NFT may be art, music, video, or even an item within a video game. Use resources such as Google, Twitter, Discord, and any other platforms where you can find any information pertaining to the NFT and its creator(s). Make sure to do in-depth research, at least 40-60 plus hours of research is recommended by serial entrepreneur, angel investor, and Web3 innovator Gary Vaynerchuk.

As well, when looking at the upcoming NFTs, note when the sale is, what the cryptocurrency requirements are, and how many of the NFTs are being sold. This helps you better understand the scarcity behind the NFT you are choosing.

2. Don’t spend money you can’t afford to lose

Only invest money that you are willing and able to lose. Nearly all investments are considered risky, so it’s important that the money you use to invest is money you don’t need. This includes money in your retirement plan and your emergency savings, you never know when you are going to need to tap into these accounts.

It’s safe to assume that any NFT you invest in has the potential to fall to zero dollars.

3. Only buy NFTs that you value

Although the market always determines the final value of an NFT, really an NFT is only worth as much as you are willing to pay for it. That’s why it’s important to only buy NFTs that you truly like. Regardless of whether it’s a piece of art, a ticket to an event, or a collectible item, you need to ask yourself what you like about the NFT, and what you plan to get from buying the NFT.

It’s simple if you don’t like art, then don’t buy an NFT art piece. You wouldn’t buy a car you don’t want to drive or clothing you wouldn’t wear. The same mindset should be had when investing in NFTs. This way, if your investment does fall to zero at least you aren’t stuck with an asset that you can’t stand looking at.

Final thoughts

NFTs are one of the most talked-about assets and investment opportunities in today’s world. But their value is unstable and should be considered an extremely risky investment considering a majority of all NFTs will fail in the long run due to lack of execution in creating a brand name and building a sustainable business that provides utility and value to consumers.

So the next time you’re thinking about buying an NFT, make sure to do your research, never spend more money than you can afford to lose, and only buy NFTs that spark your interest. Otherwise, you may be left with an empty wallet and an NFT that you can’t bear looking at.

15 thoughts on “Why 98% of NFTs Are Bad Investments (Read BEFORE Investing)”

Comments are closed.