Considering how volatile NFTs are, and will continue to be for a very long time, it can be hard to determine what price to purchase an NFT for. However, these seven essentials for assessing the price of an NFT are sure to help you make the best buying decision possible.

Seven essentials for assessing the price of an NFT include the floor price, the brand’s strength relative to its peers, the effectiveness of leadership, trends in earning growth, how the brand treats utility, long-term strength and stability, and ownership history.

There isn’t one guaranteed way to determine the exact price you should pay for an NFT. But, these seven essentials listed below will help you.

Floor price

The most obvious factor when determining the price of an NFT is the floor price — the lowest price you can pay to buy an NFT from a particular project. The floor price is one of the first essentials you will need to assess to determine the price you are going to pay for an NFT.

That isn’t to say that the floor price is the only factor. Supply is also an important factor, especially when taking the floor price into consideration. If there is only one NFT in a project and the floor price is 10 ETH, that is a major red flag.

However, if there are 50,000 NFTs in a project and the floor price is 1 ETH, then you have already determined those NFTs are worth a minimum of 1 ETH to at least 50,000 people. The market ultimately determines the price of an NFT. This means an NFT is worth as much as someone is willing to pay for it.

Brand’s strength relative to its peers

Comparing an NFT project to other NFTs in the industry is a good idea when assessing the value of an NFT. How does the brand fare against its competitors? Does the NFT stand out from other NFTs on the market? If so, why is that? These questions can help you determine whether an NFT has something other projects don’t have.

You can make a fair comparison with other NFTs on the market by finding projects with a similar market capitalization and comparing their transaction volume over a period of time to better understand their performance compared to one another.

How do you find the market cap of an NFT project? Simply multiply the floor price by the total amount of NFTs offered by a specific brand. For example, if an NFT project has a floor price of 10 ETH and a total supply of 10,000 NFTs, the market cap is estimated to be 100,000 ETH.

Furthermore, you should spend some time observing how the market views a particular NFT project. Does it have a good perception in the eyes of the community? Examples of NFTs with an overall positive perception include Bored Ape Yacht Club, CryptoPunks, and VeeFriends.

Effectiveness of leadership

Although judging the effectiveness of an NFT brand’s leadership is more of a qualitative assessment, it is crucial nonetheless. At the end of the day, when you buy an NFT you are actually investing in the person who is in control of the NFT project, and their ability to execute.

That is why it’s so important to always do your own research. How do you know if you can trust the leader of an NFT brand if you don’t even know who they are or what their track record is?

Generally, effective leadership promotes stable and long-lasting company culture and isn’t scared to try things outside of the box or to be flexible when things change. Moreover, leaders who reinvest their company’s earnings into further developing their brand can assume to be building a strong foundation for an excellent brand.

In the NFT space, it’s very common for investors to worry about the short-term floor price. As a result, leaders of certain NFT projects might try to please their consumers by pumping the floor. This kind of behavior is very short-term, and although this mindset might be okay as a day trader, it is not the kind of mindset a leader of a company should carry.

A confident leader is generally one who prefers a stable floor price over a long period of time, as opposed to pumping the floor as a quick way to please others.

To better assess the effectiveness of a company’s leader, you can look into things like how long certain leaders have been with the company, what expertise they bring to the table, and whether they are transparent and trustworthy with the world.

Trends in earning growth

Is there a trend that the NFT company’s profits generally increase over time? If so, that is a good indicator that the company is doing something right. Even if you notice small improvements over a long period of time, that is likely a positive sign.

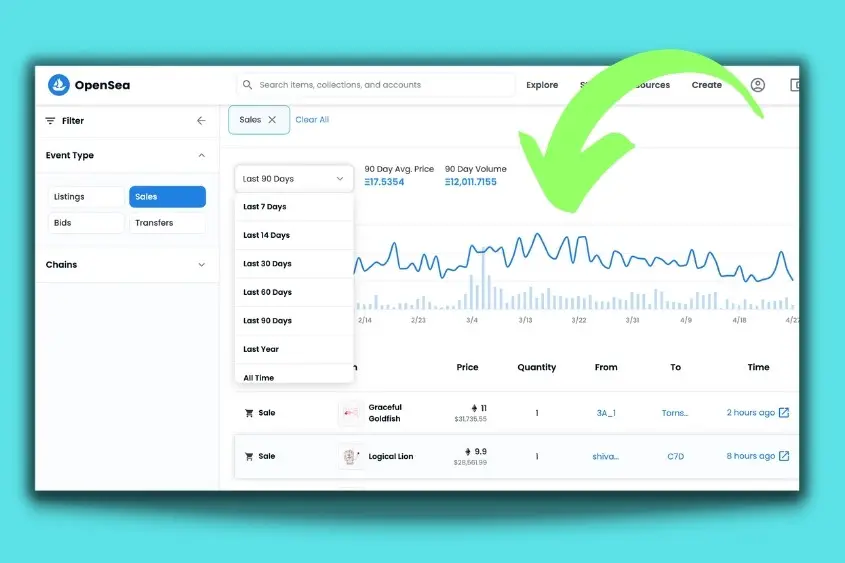

You want to use the blockchain to review the company’s financial situation. You can find a company’s transaction volume on most NFT marketplaces, such as OpenSea. It’s best to check both quarter over quarter, as well as annual trading volume to determine if the NFT brand’s revenue is growing or declining.

Companies that show positive earnings generally have financial and operational stability. This all goes hand in hand with the company’s plan to continue increasing its earnings. An NFT project that has a proven strategy to drive demand, attract new consumers, and develop new products and utilities might be an NFT worth buying.

How the brand treats utility

An NFT that also provides holders with utility is often one with a certain degree of stability. This is especially true if the utility is not a simple one-and-done deal, but rather, a utility that evolves over time as the brand continues to grow.

That is one of the greatest things about NFTs. Leaders of the brand are able to continually add value through utilities that are only offered to NFT holders. The NFT’s utility might not always be something that is offered upfront, rather, as the brand is built over a period of time the utility is added.

Examples of utility include access to exclusive events and information, physical and digital products, as well as services.

Long-term strength and stability

There is absolutely zero doubt that the NFT market is extremely volatile. This also means that it is almost inevitable that an NFT brand won’t lose value in the market at some point in time. The reasons for something like this happening are abundant — world events like war, natural disasters, and pandemics are a few examples — but the most important factor is long-term stability.

An NFT project that can withstand a bear market and come back even stronger is probably the NFT you want to buy. If you notice a strong NFT project struggling at the same time the entire market is struggling, that’s considered normal as long as the brand remains flexible.

A stable NFT brand will usually exhibit several characteristics, such as increased revenue, low to moderate debt levels, an overall positive perception in the industry, and a strong leader or team of leaders.

Ownership history

NFTs are different from stocks because the NFT might be held by an influential person, such as the creator, before being transferred from the creator’s wallet to the consumer’s wallet upon purchase.

The blockchain is what allows you to view who has previously held an NFT, and for many people, this might be seen as added value. Imagine if you bought a ticket to a concert directly from your favorite artist, or perhaps an article of clothing directly from the designer. That is exactly what ownership history is referring to.

Before NFTs, this would be difficult to prove. Now with NFTs, you are able to see who all has held an NFT until the end of time. Ownership history is a newer aspect, but not one that should be overlooked when considering the price of an NFT.

How does the value of an NFT increase?

The value of an NFT increase as the brand’s reputation is built over time. The founder is ultimately responsible for creating supply and driving demand for the product or service being offered through NFT technology.

Think about the brands we all know and love today. Nike, Apple, Amazon, and Tesla, for example, have all built something that people want. They continue to innovate as time goes on, and as the world continues to change. The reason most people are willing to pay ten times more for a pair of Nike shoes compared to some of their lesser-known competitors is that Nike has built their brand name.

It is not much different when it comes to increasing the value of an NFT. Build something meaningful, and the demand is a direct result. Build something subpar, expect the NFT to have little to no value. To learn more, check out our article that explains exactly how NFTs gain value.

Should you buy an NFT?

Deciding whether you should buy an NFT or not comes down to your personal goals. Before you buy an NFT you should ask yourself why you are buying an NFT. Is it an investment? Does it provide value to you in some way? Are you buying one simply to learn more about the process?

Be honest with yourself and your goals. Many people buy NFTs as an investment, or to gain some sort of value from being a holder. Again, this value can appear in the form of a physical product, access to an event, or another type of product or service. If you are buying an NFT to gain the instant utility and you can afford it, I think you’ve got your answer.

If you are buying an NFT as an investment in a company or brand, then you should continue asking yourself more questions. What are your goals with your investment? How much money are you trying to make? Is it a long-term or short-term investment? Answering all these questions will help you make the best decision when asking yourself if you should buy an NFT.

Buying an NFT as an investment requires more knowledge, in-depth research, and a lot of patience. You want to make sure you know everything about the company and the NFTs they are offering before you decide whether buying an NFT is right for you.

How much should you spend on an NFT?

If you decide that buying an NFT is right for you, the next question is how much are you willing to spend? Or rather, how much should you spend?

You should never spend more money on an NFT than you can afford to lose. Most financial planners advise investing between 10% and 15% of your annual income. Buying NFTs as an investment is extremely risky, so spending money that you need is not advised.

Personally, I would rather save up enough money to buy an NFT that I have thoroughly assessed on and presume to be a good investment, versus risking spending smaller increments of money on a lesser-known NFT project.

However, if you assess an NFT project that is fairly new and inexpensive, and you come to the conclusion it might be worth buying, then more power to you. Keep in mind it is more difficult to assess a new company as there is less historical data to assess.

Determining the price you should pay for an NFT can be difficult, but it doesn’t have to be. There are essentials for assessing the price of every NFT you buy that will lead you to make the best buying decision. Ultimately, the market decides the price of an NFT. The only way to tell if you agree with the market is by doing your own research.

2 thoughts on “7 Essentials for Assessing the Price of Every NFT You Buy”

Comments are closed.