The NFT market has seen its fair share of ups and downs. After reviewing DappRadar’s Industry Report, here’s everything we know about what’s happening to the NFT market.

The NFT market is experiencing a correction. Due to extraordinary high speculations of early NFT projects and brands, many of them have declined from their speculated prices which triggered a majority of investors to panic-sell, resulting in an overall decline in the market.

That being said, there are a lot of moving parts to the NFT and Web 3.0 space that plays an important role in the overall market. This article aims to provide an in-depth look at the current NFT market, as well as where we might be heading in the future.

Is the NFT Market Collapsing?

The NFT market is not collapsing, it’s adjusting. There are many aspects we must examine to determine why the market has experienced a decline and what the future of the market might hold. Let’s take a look at the past, present, and future NFT market to help us better understand what exactly is going on.

The Past

On May 3rd, 2014, the very first NFT, Quantum, was created on the Namecoin blockchain. At this point in time, there was virtually no NFT sales volume that has been recorded. According to this market tracker, the first NFT sales occurred on Monday, November 20th, 2015. On this day, four NFTs were sold for a total transaction volume of $146.31.

From then on, it wasn’t until February 2021 that the NFT market saw a significant upward trend in NFT transactions. That’s not to say that 2017-2020 was completely lifeless, however, it was nothing to gawk at.

2021 was the first year that you could say NFTs really took off and hit mainstream. Projects like CryptoPunks and Bored Ape Yacht Club, as well as artists like Beeple, were able to foster attention for the technology when their NFTs began selling for millions of dollars.

These transactions gained the attention of the mainstream media, with headlines like: “JPG File Sells for $69 Million, as ‘NFT Mania’ Gathers Pace”.

This sparked the curiosity of many creators and investors around the world, igniting what we now refer to as the ‘NFT Space’, creating a digital gold rush. This trend of buying JPGs for large sums of money continued throughout 2021, as we saw hundreds of new NFT projects sprouting up on a daily basis.

Those who were bullish on the technology threw thousands of dollars at various NFT projects (most of which had only been around for a few days to months), without even batting an eye. Even though innovators at the forefront of the technology, such as serial entrepreneur, Gary Vaynerchuk, warned others to always “do your own research” (DYOR), many of us failed to do so.

As a result, people would lose thousands of dollars in a matter of days. Either from getting scammed or because they went into panic mode and sold all their assets, just to buy into the next best NFT project, and then do it all over again.

This cycle of overspending continued as the masses joined in, attracting both Wall Street and Main Street investors into the space in an attempt the become overnight millionaires. To be fair, many investors did become millionaires, but others have lost incredible amounts of money.

That leads us to the current market situation we find ourselves in.

The Present

Rolling into 2022, the market was as strong as ever, then come February, we began to see a steep decline. The initial descent of the market is believed to be a much-needed adjustment. It was simply adjusting to the fact that there was too much supply and not enough demand. But then, other factors came into play.

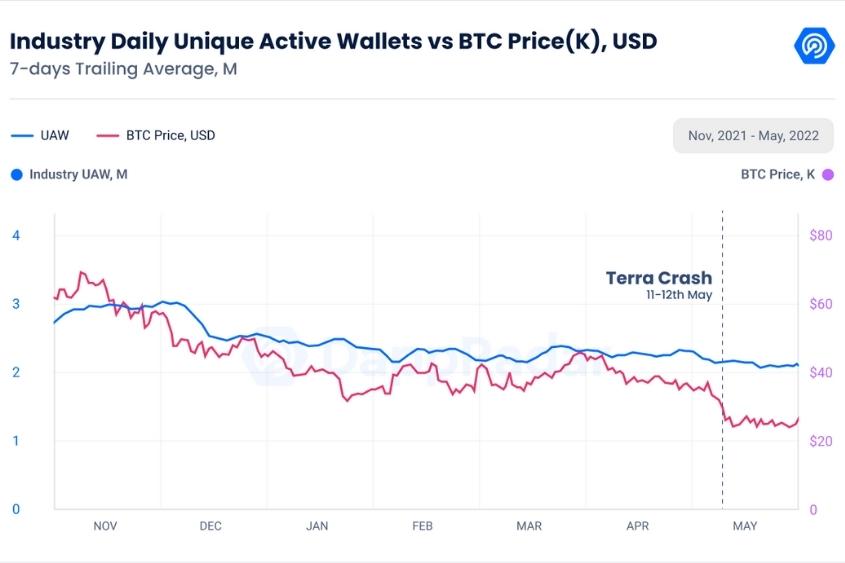

The Debacle of Terra

Terra was once the second-largest Defi ecosystem in the world. That was until it crashed on May 9th, 2022. Although the reason for Terra’s crash is still under investigation, there are rumors circulating as to what might have caused it.

In an attempt to combat the crash, the Luna Foundation Guard (LFG) used 79,687 BTC (worth around $3.5 billion) to keep UST value afloat.

Still, in the end, the ecosystem couldn’t handle the pressure inflicted by the death spiral as the value of LUNA (classic), ANC, and other relevant tokens to the network were not enough to help UST regain its peg.

The collapse of Terra resulted in a $60 billion disappearing act, the most significant wealth loss in modern history. With that, Bitcoin lost its line of support, dropping under $30,000 for the first time since December 2020.

Since then, Do Kwon, Terra’s co-founder, announced a revival plan that initiated a hard-fork of the network named Terra 2.0, which came to fruition on May 28. On that day LUNA Classic token holders received the new version of LUNA through an airdrop, but with a 99 percent loss in value.

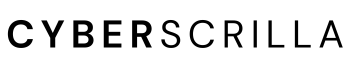

According to DappRadar, several other altcoins have dropped 90 percent from their peak reached in November last year. Likewise, Dapp activity has hit its lowest point in 2022 as 2.22 million daily Unique Active Wallets (UAV) connected to blockchain Dapps in May. This is a 5 percent decrease month-over-month (MoM), although it’s still 32 percent higher than May 2021.

Not all blockchains are experiencing a decline in activity though. Solana, for example, has seen an increase in usage, surpassing 200,000 daily UAV for the first time in its history, despite the continuous infrastructure problems that have disrupted the network on multiple occasions.

It’s not all bad news though, as peer blockchains are taking advantage of the situation, harnessing the developer talent and audience that Terra left behind.

The Future

Despite everything that has occurred, the market continues to progress. With that, this may just be the beginning of a very long NFT winter.

In November 2021, Gary Vee said: “An NFT winter is coming, a crash driven by short-term greed, supply and demand issues.” Then, in a more recent interview with Yahoo Finance, Gary referenced his own quote saying: “That is absolutely potentially what we are in. It’s just starting.”

Gary continued, saying that the people who thought it was crazy that NFTs were selling for millions of dollars were right because it is crazy. “It was as crazy as internet stocks in the late 90s being worth $400 million for pets.com,” he said.

“The valuations on Wall Street were overblown. The valuation of NFTs in this first year are overblown because people get overexcited, gold rush, short term, quick cash. But the fundamentals are real. The macro is super right, NFTs are here forever. The micro was wrong, that’s why we’re correcting.”

To Gary’s point, whether we are just at the beginning phase of this aforementioned winter or even if it’s years away, the technology is here to stay.

Is the NFT Market Dead?

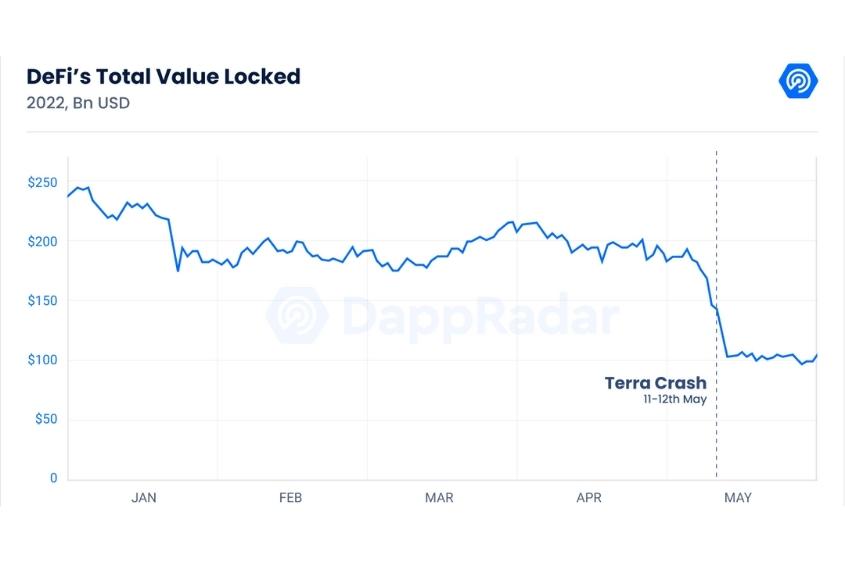

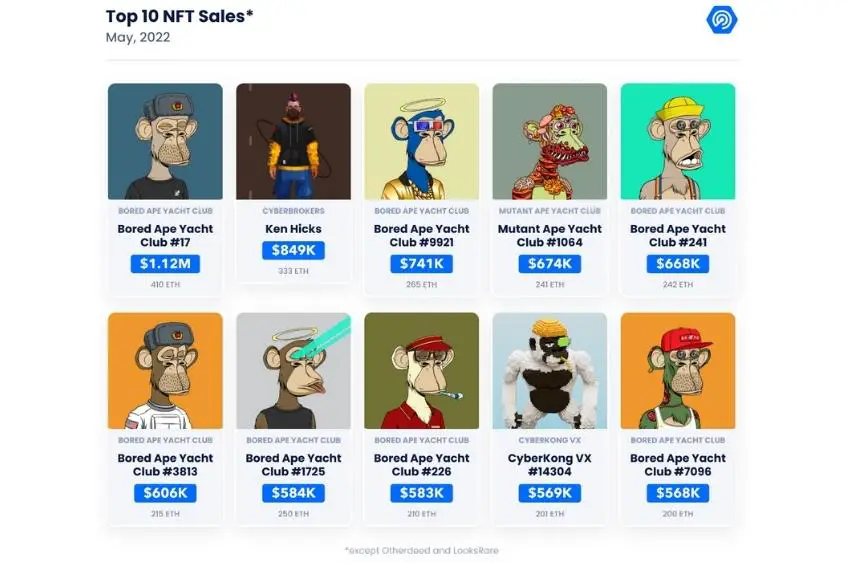

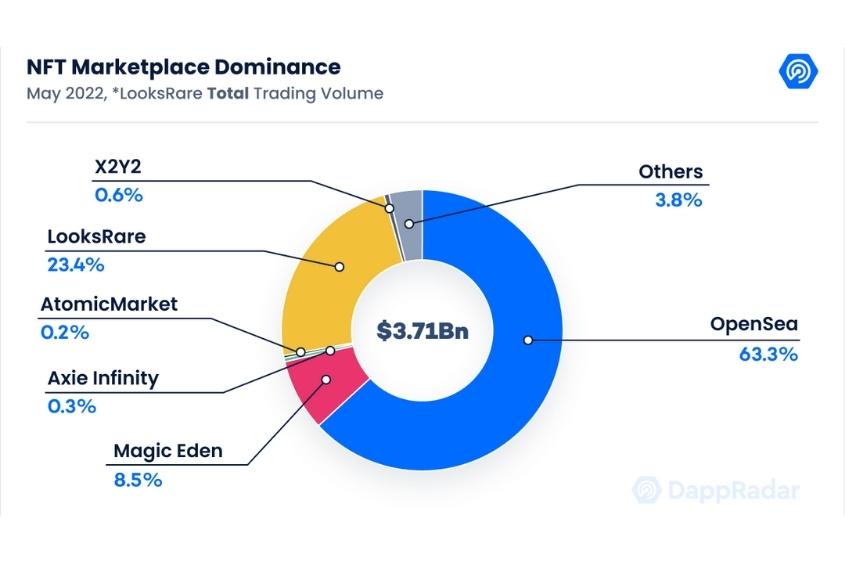

The NFT market is far from dead. In May 2022 alone, the market generated $3.7 billion. While the trading volumes measured in USD show that the market is contracting, analyzing the marketplace volumes and their native tokens prove that the market is still generating billions of dollars in sales volume.

For example, OpenSea, the industry’s largest NFT platform, produced 950,000 ETH in trade volume in May 2022, a 6.5 percent decrease from April. Volumes in USD provide a distinct view since changes in ETH price have a significant influence on the data.

The volume of OpenSea trading in USD declined by 25 percent month over month. When both viewpoints are compared, there is an 18.5 percent disparity in both USD and ETH quantities.

Furthermore, Solana NFTs have withstood the bear market trend having had their best trading month in history, in May. Generating more than $335 million across all its marketplaces, the network grew a whopping 13 percent from April.

Despite the overall negative perception of NFTs and the apparent death of the market, the space continues to evolve through the growing pains. Additionally, the NFT space continues to witness how new collections can shift the narrative of the entire space.

How Does the Bear Market Affect Blue Chip NFTs?

When the market is down, blue-chip NFTs experience a decline in price as well. At the height of the crash, the BAYC floor fell from 150 ETH to 93 ETH, a 38 percent decrease, and Doodles experienced a 48 percent decrease from 23 ETH to 12 ETH.

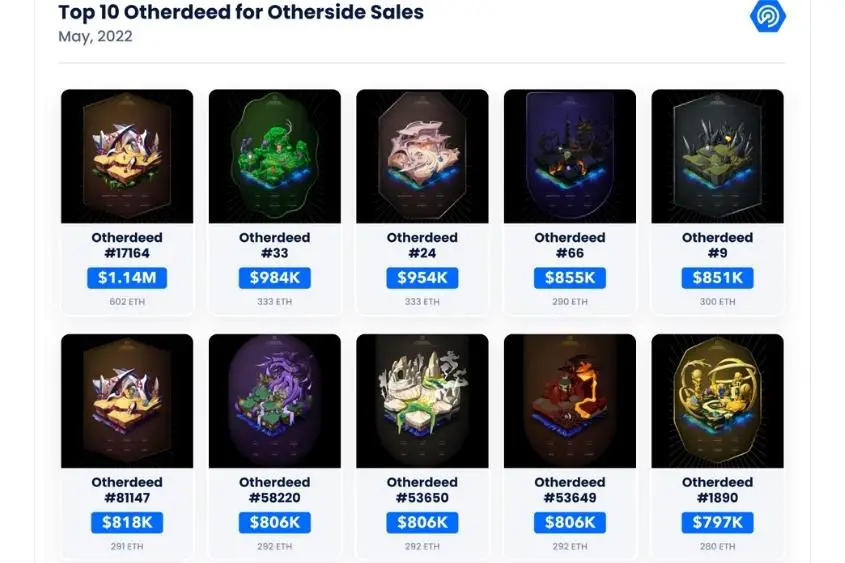

There is some good that comes from a down market as well, as it is considered to be a good time to build something great. In the NFT space, projects like Otherdeeds propelled virtual worlds to their best month in history.

Likewise, Goblintown came out of the shadows, generating $31 million in a two-week period.

Moreover, ENS collected 41 percent of its all-time volume in May after the 10k Club launched its own NFT collection based on 10,000 numbered ENS domains, generating over $18 million in sales in the first week. Even in a down market, these projects have seen a significant increase in demand, and as a result in price as well. Goblintown was a free mint that rose to a 6 ETH floor in a matter of days.

As well, the average sales price of ENS went from 0.07 ETH in April to 0.11 ETH in May, and the 10k Club and 999 Club (the first 999 NFTs from the 10k Club) reached a floor price of 0.7 ETH and 8 ETH, respectively. While new potential blue-chip NFTs are being built, several of the existing blue-chips have seen their value decline in the bear market.

There’s no doubt that hype around some of the new collections has pulled some liquidity from the market, but not all of it. Several other events related to these respective blue-chip communities were the main contributors to the price decrease.

Ultimately, the loss in value of the top-tier NFT collections caused a downturn in the NFT Market Cap for the top 100 Ethereum collections. At the same time, the price of ETH decreased 37 percent, but the snowball effect of blue-chip projects brought the metric down to 45 percent to $10 billion, from the previous month of $18 billion.

Still, blue-chip collections were among the most traded NFTs despite the plunge in numbers, proving that their communities are simply experiencing a consolidation period. That being said, the value of NFTs decreased at a lower rate than underlying cryptocurrencies during the down months.

This is similar behavior to the Art100 index when in The Great Recession of 2008, lost 26 percent of its value compared to the 56 percent loss of the S&P 500. Just maybe, NFTs could be the assets that separate from the financial markets at some point, but only time will tell.

Down Market Affect on NFT Marketplaces

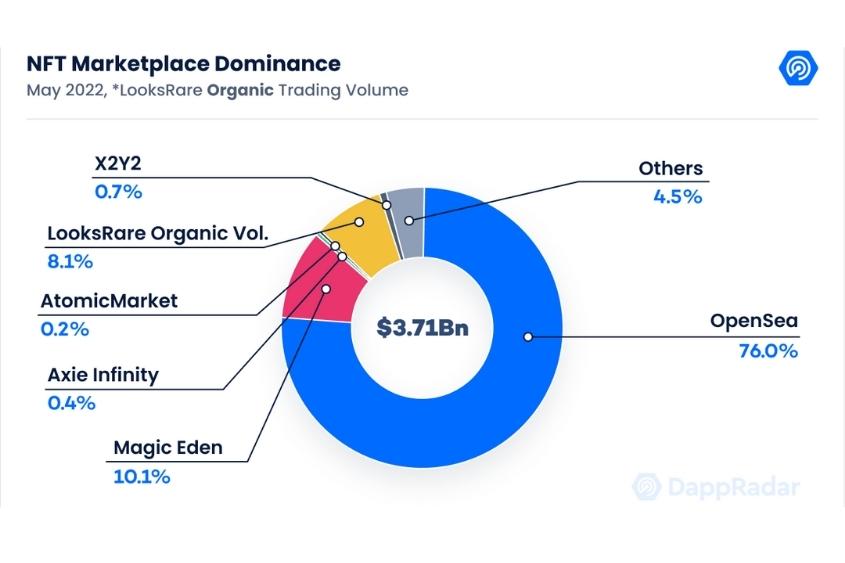

According to DappRadar, the down market has seen an increase in organic activity in various NFT marketplaces. OpenSea’s volume dominance has fallen from 90 percent in the first four months of 2022, to 84 percent measured in May.

This is despite a 2 percent month-over-month increase in the number of UAW members who engaged with the market in May (398,000 UAW). Marketplace aggregators like Gem and Genie have helped LooksRare and X2Y2 gain prominence by giving a comprehensive perspective of the NFT industry.

LooksRare drew 30,000 UAW in May, increasing its user base by 22 percent from April.

Using the hildobby (a well-known Web3 data scientist) algorithm to filter wash trading activity*, we can observe that organic volume increased 473 percent in the community-driven marketplace, hitting $250 million in organic transactions in May.

Similarly, X2Y2, an Ethereum marketplace with a 0.5 percent transaction charge, increased its user base by 93 percent MoM in May, drawing 11,500 UAW. The market generated $22 million in trading volume, a 286 percent increase over the previous month. As the NFT space matures and competition heats up, Opensea has undoubtedly decreased in overall dominance.

Still, Opensea will remain the obvious choice for many in the foreseeable future. The down market also provided an opportunity for the platform to revamp its appearance with a new layout and user experience.

In addition, Opensea acquired Gem on April 27 and released an open-source platform to help creators launch their NFTs, called Seaport. Proving that the down market can also be a great time to innovate.

Have Blockchain Games Been Affected by the Bear Market?

Blockchain games have suffered the least when compared to other industries in the bear market. The number of game transactions and the number of daily UAW connected to game Dapps decreased only 5 percent compared to the previous month, showing real engagement atop the charts.

Also, VC capital has been flowing steadily to metaverse and blockchain game-based projects.

In May, Dapper Labs announced a $735 million fund to accelerate growth in the Flow ecosystem in addition to a16z’s huge $4.5 billion commitment for its crypto fund that focuses on developing blockchain projects.

With all that money, the blockchain gaming industry is continuing to add more skilled developers to its lineup. Dapps like STEPN and Genopets are a perfect example, having embedded gamification elements to physical activities in the move-to-earn trend.

Lastly, the play-to-earn BAYC metaverse, Otherside, produced $760 million in May, propelling virtual world NFTs to their biggest month to date with $850 million in sales.

Ultimately, the lack of suffering seen in the gaming industry is likely the result of dedicated gamers who really just enjoy playing the game.

Compared to the large majority of the NFT community who are risking money they can’t afford to lose in an attempt to strike digital gold, leading them to pull liquidity from the market, hence digging an even deeper hole.

Final thoughts

The current bear market and the demise of Terra have undoubtedly accentuated the effects of the downward trend. Not only have we seen crypto prices plummet, but we’ve also noticed a slight decrease in enthusiasm from the community as well.

However, now more than ever might prove to be the perfect time to innovate, adapt, and continue to grow. User adoption along with an increase of Web3 developers is a positive sign of continued growth.