If you’ve been dabbling in NFTs then you might have heard the term “blue chip”. Only the most sought-after NFT projects are lucky enough to have this term associated with them. If you aren’t buying blue chip NFTs, you shouldn’t be buying NFTs at all. After investing my life savings in several blue chips myself, I’ve learned exactly what it is and how to find one.

Below I share exactly what a blue chip NFT is and how to find one for yourself. Let’s get into it!

What Is a Blue Chip NFT?

Blue chip NFTs are projects that are profitable and tend to maintain their value in the long term. Blue chip NFTs share multiple characteristics such as a relatively high floor price, brand power, thoughtful collaborations with other brands, real-world utility, and a dedicated team.

The term blue chip NFT has its reference in physical finance. In the real world, a blue chip bet, stock, bond, etc. means an asset in which you can invest for the long term. Because you will be enjoying an unaltered flow of returns from the investment for years to come.

Similarly, blue chip NFT means a non-fungible token in which you can safely invest. Because the appeal or value of that NFT is not going to fade anytime soon to the people on the blockchain. Instead, it will only increase with time.

NFT projects which show promise of providing long-term returns on their investments are considered blue chip NFTs. If someone invests in these NFT projects, they will probably make a nice profit if they sell them in the future.

Blue chip origin can be found in poker. In three-color poker sets, the chips are usually red, green, and blue. During a game, this blue chip will hold the highest value when compared to other colors.

If we look at the traditional world, examples of blue chip companies are Costco, Coca-Cola, Amazon, Apple, Tesla, TATA, Reliance, etc.

If you have money and these companies are willing to sell their stocks, you can invest in them and logically hope to benefit in the long term without any worry of losing your investment.

The case is the same in the world of NFTs and digital finance. NFT projects like Crypto Punks, Bored Ape Yacht Club, Cool Cats, and VeeFriends are allowing participation in their venture, meaning you can safely invest some cryptocurrency and have a rational expectation of success in the coming future.

Blue Chip NFTs Compared to Classic Blue Chip Companies

There is one noticeable difference between blue chip NFT projects and blue chip companies of the physical world, and that lies in the type of the companies.

Blue chip NFT brands compared to the classic companies we know and love today are really not much different. The only thing that is different is the technology platform and the form of investing, however, the standards that make up a blue chip brand stand the same for both NFTs and companies that are publicly traded.

Usually, blue chip companies that are publicly traded have been operating for quite some time now. These companies have established themselves in society and their social impact has a huge effect on people wanting to buy their stocks.

On the other hand, most blue chip NFT projects are comparatively new. This is no surprise considering NFT technology is relatively new as well.

For example, one of the blue chip NFT projects in recent times is the Bored Ape Yacht Club. But they have only been around since April of 2021. One of the “older ” successful projects Crypto Punks is not older than 2017.

Therefore, people invest in blue chip NFTs based on prediction. Those who have been navigating the world of cryptocurrency and NFTs for a while can make such predictions from their experience and apply logic. You too can do that. And we shall look into that in the following section.

You can compare investing in NFT brands similarly to how people were investing in internet stocks in the early 2000s when most of those stocks ended up being worth zero dollars. That’s why I believe that 98 percent of NFTs are bad investments.

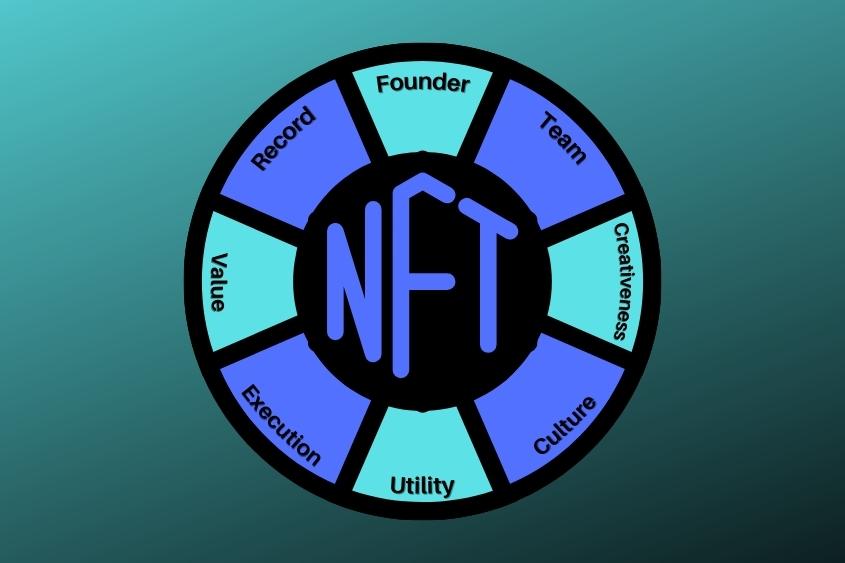

What Makes a Blue Chip NFT?

You can gather from the above discussion that investing in a blue chip NFT is somewhat trickier than a blue chip stock. Because you probably have to figure out which is going to be a blue chip NFT project on your own. Therefore, it is important that you first understand what makes a blue chip NFT.

What makes a blue chip NFT is a reputable brand name, the positive status of the creator and team, the past success of the humans, the current price, its acceptance in the community, and the willingness to adapt in order to stay culturally relevant.

If an NFT project is created by a successful operator and is gathering up a cult-like following,then there is potential that it will become a blue chip NFT. Below are some common traits found in Blue Chip NFT brands.

Feel free to reference this NFT collector’s guide that I created to help others find a good NFT brand.

1. The brand itself

Like other blue chip companies worldwide, a blue chip NFT brand is generally popularly known and well-respected by the masses. Blue chip brands are known to change with the times and be open to new trends, especially the ones that may be culturally relevant at the time.

Some NFT projects such as CryptoPunks gain their blue chip status because of how early they were to the space. Punks were originally given away for free but were eventually collected by many because they are considered to be the first 10k profile picture NFT project, making them historically significant and culturally relevant for years to come.

Usually, blue chip brands have an overall positive reputation in society, and may even be known and enjoyed worldwide. Moreso, brands that often give back to the world and share their joy and success with others will maintain their positive reputation for decades. This is why blue chip investments are considered to be excellent long-term investments.

2. The creator(s) reputation

Of course, you likely won’t have a good brand without a good leader and team backing it. That’s why the human(s) behind the brand really matters. If you find that the people who are a part of the team have a good reputation then this is a good sign and increases the likely hood of the brand attaining a “blue chip” status.

One example of a creator’s reputation playing a role in the NFT space is Gary Vaynerchuck and his VeeFriends NFT project. Gary was originally known as the “wine guy” when he first started to gain attention, eventually, he opened his own media brand called VaynerMedia, which now employs over 1,500 employees.

Along with his extremely successful company, Gary has established a huge social media following all around the world, mainly because people love the business and personal advice he’s always creating for free.

But really it’s because Gary is a genuinely good person with good intentions, and people can sense this. That’s why when Gary launched his VeeFriends NFT project in May of 2021, he had no problem selling over $20 million worth of NFTs in a matter of weeks, and currently has seen over $130 million in trading volume since launching the VeeFriends NFT brand.

While it is not mandatory that you have to invest in a famous or well-known creator from the start, it may certainly help improve your odds of investing in a blue chip brand.

For example, some creators have emerged first in the NFT community solely as NFT artists (Cool Cats, Doodles, etc.) and are now considered to be blue chip NFTs.

These creators keep themselves busy and always put forth new and innovative things. So, you can look to them for investment opportunities.

3. Execution of the brand

I think it’s safe to say that if an NFT project has a good brand identity and the team behind the brand has a solid reputation, then the execution of the brand as a whole is generally very good.

Many NFT projects will have a roadmap that you can easily view to see exactly what they have planned and when they are thinking about executing such ideas, but not all brands successfully execute their roadmap.

This is what will separate a blue chip NFT from an average one. If a brand executes what they promise to deliver, or even better, over-deliver, this is a good sign that the NFT brand may become a blue chip NFT.

This is why you can guess a lot about the future performance of an NFT brand if you observe the behavior of the entire team and their execution of delivering what they promise.

NOTE: Some NFT scam projects will use a lazy version of the tactics mentioned above to create what seems like a potential blue chip NFT, but are nothing more than a cash grab. Rug pull scams happen all too often and should be avoided at all costs, luckily I have covered this topic extensively so you can know what to look for.

Why Are Blue Chip NFTs Important?

Blue chip NFTs are important because they provide a means to invest in something great, and earn a return on your investment. Moreover, the blue chip brand can continue to deliver a good product/service and value to the world if they have continued support.

If someone is not accustomed to the world of web3 and sees someone else spending a fortune on a digital asset, what would their reaction be? They will probably think the other person is crazy, and rightfully so.

Most NFTs will not ever become a blue chip, but the brands that continue to execute and deliver value to their consumers and build their good reputation will ultimately be known as the blue chip brand for a long time into the future.

In general, an NFT that has more use for its owner rather than just providing a product that doesn’t have any value would have more appeal to the community.

Many blue chip NFT projects have some kind of utility. Some NFT investors get regular merchandise from their projects, access to events, or even one-on-one sessions and other resources that will ultimately help the collector in their own journey.

Keep in mind that these are just examples of the present times. In the future, the more utility an NFT has for its investor, the more successful it will be.

What Are Examples of Blue Chip NFT Projects?

There are numerous blue chip NFT projects you can look to that stand as a proper example when determining what a successful project might look like. Below are some of those examples.

CryptoPunks

CryptoPunks is one of the most sought-after NFT projects of our time. Punks were one of the first NFT projects to gain popularity and help NFTs gain mainstream adoption, as a result, celebrities like Jay-Z use these NFTs as their profile picture on social platforms.

Since its origination, CryptoPunks has continued to build its brand through various collaborations, events, and a strong community—making it stable in the industry.

Bored Ape Yacht Club (BAYC)

Bored Ape Yacht Club is right up there with Punks. Both brands are owned by the same company after all. More importantly, BAYC has made some strategic partnerships with other well-known brands like Rolling Stone and Adidas to name a couple—further solidifying their blue chip status.

Hence, Bored Ape has become a household name amongst every crypto and NFT enthusiast.

VeeFriends

VeeFriends is an NFT project created by serial-entrepreneur Gary Vaynerchuck. Gary has built several successful businesses, made numerous wise investments, and continues to operate his 1,500-employee company, VaynerMedia, on a daily basis.

That said, VeeFriends is nothing to scoff at. What many believe to be just another NFT project that began with poor drawings, is actually Gary’s newest and greatest ambition.

Considering the value he has already provided to VeeFriends NFT holders, along with countless collaborations including toys that debuted in Toys’R’Us around the United States, IRL events and activations, and much more, VeeFriends is undoubtedly one of the most obvious blue chips in the industry.

To be fair I might be a bit biased since I own multiple VeeFriends NFTs, but even if I didn’t, I’d still have the same conviction.

Hours of research combined with conviction can put you in a situation where you’re able to not only find blue chip projects but also make wise investments yourself.

How to Keep Your Blue Chip NFTs Safe

To ensure your blue chip NFTs remain safe, you need to store them in a hardware wallet. This type of wallet stores all its private information on the device itself, rather than online, such as with a software wallet. Keeping your assets in a hardware wallet makes it near impossible for hackers to gain access.

If you own a blue chip NFT or are considering buying one, learning how to properly store it is essential. There is no worse feeling than spending your hard-earned money on something just to have it stolen from you. With all the NFT scams in the space, the likelihood of your digital assets being taken from you is quite high.

However, if you learn what to watch for and utilize the safest NFT wallets, you greatly reduce the risk of losing your high-valued assets.

20 thoughts on “What Is a Blue Chip NFT? (Meaning and How to Find One)”

Comments are closed.