The choice between using a hardware wallet or settling for another type of crypto wallet can be tough. That is why it’s important to consider all the pros and cons of hardware wallets before making your decision.

The main benefits of hardware wallets are high security, immunity to online threats and malware, and control over your private keys. Drawbacks include less convenience in making quick transactions, a potentially steep learning curve for less tech-savvy users, and the cost.

Notably, not all hardware wallets are created equally. That’s why we hand-picked this list of the best hardware wallets for you. After you learn about these hardware wallet pros and cons, you can use this list to find a device that suits your budget and needs.

Contents

Hardware Wallet Pros and Cons

Pros:

- Complete control over private keys

- Improved security measures

- Immunity to online threats and malware

- Enhanced user privacy

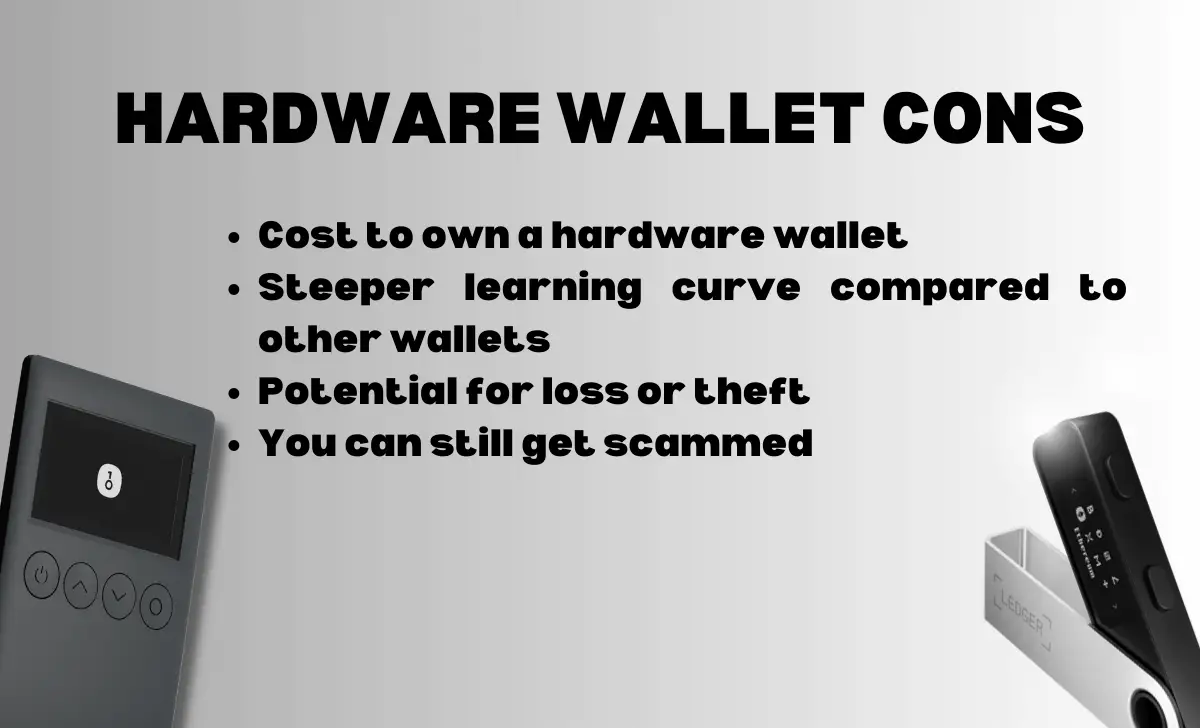

Cons:

- Cost to own a hardware wallet

- Steeper learning curve compared to other wallets

- Potential for loss or theft

- You can still get scammed

Hardware Wallet Pros

Complete control over private keys

Also known as “cold wallets” or “cold storage”, hardware wallets are physical devices designed to securely store your wallet’s secret recovery phrase offline making them immune to online threats like hacking and malware attacks.

This additional level of security can’t be matched by software wallets (aka hot wallets), making hardware wallets the ideal way to store your blockchain-based assets.

For instance, compare hardware wallets with software wallets hosted online or on your personal computer or smartphone.

In the event of a cybersecurity breach, digital wallets can fall into the wrong hands, and your digital assets could be stolen. These common crypto scams happen all the time.

This is especially true if you hold your cryptocurrency on a centralized exchange like Coinbase. Exchanges can also fall victim to hacks or go out of business, unexpectedly close your account, and take your funds.

Why? Because the exchange owns your crypto. With a hardware wallet, your assets remain in your sole possession.

Improved security measures

Beyond simply storing your private keys offline, hardware wallets have numerous security measures in place to protect your crypto investments.

Here are some common security features hardware wallets have.

- Secure element chip. This specialized chip embedded in some hardware wallets enhances security by securely storing private keys and performing cryptographic operations. It’s also used in bank cards and electronic passports.

- Air gap technology. Air gap technology ensures that the hardware wallet is physically isolated from internet-connected devices, minimizing the risk of remote attacks and unauthorized access to your funds.

- Anti-tamper mechanism. A protective feature that detects and responds to any physical tampering attempts, such as opening the device, ensuring the integrity and security of your stored crypto assets.

- Biometrics. Some cold wallets use fingerprints or facial recognition to provide an additional layer of authentication and ensure that only authorized individuals can access the device and approve transactions.

- PIN and passphrase protection. The use of a user-generated PIN and passphrase to prevent unwarranted access to your wallet is a basic security measure used in nearly all hardware wallets.

- Open source firmware. Software that is openly accessible and auditable by the community allows for transparency, collaboration, and verification of a wallet’s security measures.

Immunity to online threats and malware

Computer viruses, malware, and ransomware are persistent threats to digital wallets stored online or on personal computers. Hackers use this malicious software to infiltrate systems and exfiltrate your cryptocurrency.

Since hardware wallets keep your coins offline in a ‘cold storage’ format, they are immune to such threats.

That said, if you think that you are immune to these threats you’d be surprised. Malware can be downloaded onto your device in a number of ways including:

- Opening or downloading a file

- Clicking an ad you see online

- Phishing emails

- Compromised websites

The worst part is that you usually don’t know you are affected until your wallet is already drained.

Enhanced user privacy

Hardware wallets are designed to provide unparalleled privacy to their users.

Unlike crypto exchanges or software wallets that require a certain degree of sharing personal information, hardware wallets allow you to maintain full control over your private keys and your digital assets without revealing your identity.

Imagine receiving some Bitcoin from a friend; using a hardware wallet, you can receive, store, and send the Bitcoin without your details or transactions being linked to your personal identity.

This feature of hardware wallets aligns with the core principle of crypto and the entire web3 space, which is decentralization and privacy.

To be clear, your transactions are still publicly viewable on the blockchain, but they aren’t linked to your personal identity.

Hardware Wallet Cons

Cost to own a hardware wallet

The foremost downside of hardware wallets is their price. While one can download software wallets like MetaMask free of charge, hardware wallets usually cost between $50 to $350.

This figure does not factor in any potential shipping or customs costs that might apply to buyers from different territories.

However, there’s a saying that goes, “You get what you pay for” — this rings true when considering the unrivaled safety and privacy benefits that hardware wallets deliver, frequently surpassing their initial outlay.

Steeper learning curve compared to other wallets

When compared to their software counterparts, hardware wallets have a slightly steeper learning curve.

While digital natives or tech-savvy individuals may navigate these devices with ease, less technologically-inclined users may find the setup and operational process somewhat daunting.

This operational complexity is compounded by the fact that hardware wallets require the use of companion software wallets for transactional purposes.

Widespread adoption of hardware wallets could be limited if user-friendliness isn’t addressed.

However, as the technology evolves these wallets are predicted to undergo enhancement and modification to increase accessibility and user-friendliness.

Fortunately, cold wallets like Tangem already offer some of the most user-friendly and secure cold wallets on the market.

Potential for loss or theft

While hardware wallets provide a high level of security against online hackers, their physicality introduces the risk of loss, theft, or damage.

Just like cash or jewelry, if a hardware wallet is stolen or misplaced, the user could lose access to their stored cryptocurrencies.

While this issue also applies to software wallets to an extent, recovery of digital wallets is often easier if users have backed up their data or written down their private keys separately.

In this regard, hardware wallets come with a backup seed phrase that can be used to restore your funds on a new device if the original one is lost. It’s crucial to keep this backup seed in a safe and secure place.

You can still get scammed

Users may develop a false sense of security with hardware wallets. While they are the most secure option for storing digital assets like crypto and NFTs, they are not invulnerable to scams.

Phishing links, a prevalent scam, aim to trick users into connecting their wallets, granting hackers access to funds. Some hardware wallets offer protection against malicious connections, but users remain responsible for their wallet’s security.

Unfortunately, many users are completely unaware of this scam or how to properly secure their hardware wallets, making them vulnerable to falling victim.

Frequently Asked Questions

What is a hardware wallet?

Hardware wallets are physical devices designed to safely store digital assets such as cryptocurrencies. These devices are offline, also known as “cold storage”, meaning they are not accessible via the internet, which greatly reduces the risk of hacking and digital theft.

Is it better to have a hardware wallet?

Hardware wallets offer the highest level of security for storing and managing private keys and crypto assets. With the ability to generate and store keys on a physical device, they provide protection against online scams and physical tampering, ensuring the safety of your digital assets

Can you trust hardware wallets?

Yes, you can trust hardware wallets thanks to their robust security features, including encryption and tamper-resistant hardware. They have a proven track record of safeguarding crypto assets, making them a reliable choice.

Do I own my crypto on Coinbase?

No, you don’t actually own your cryptocurrency on Coinbase. While you have legal ownership of your crypto on Coinbase, it’s stored in a custodial wallet controlled by Coinbase. This means Coinbase has control and responsibility over your assets.

What’s the safest device to store your crypto?

Hardware wallets are the safest devices for storing crypto due to their offline storage, strong encryption, and resistance to malware attacks. They provide an extra layer of protection against many potential vulnerabilities.

1 thought on “Hardware Wallet Pros and Cons in 2023”

Comments are closed.