NFTs are becoming the choice investment for both the middle-class and Wall Street investors alike. That being said, there have been many ups and downs in the space. In this article, I aim to point out all the pros and cons of NFTs so that you can consider each one before learning how to buy one or make your next move.

So, are NFTs good or bad? Here are 16 pros and cons of NFTs.

Pros Of NFTs

1. Economic Opportunity

You’ve seen the headlines. When Beeple sold his NFT for $69 million, word quickly spread of the potential that NFTs hold for creators and investors alike.

Although there are many considerations as to why Beeple’s NFT sold for so much money, it doesn’t change the fact that it did. While this sale is an extreme example of the economic opportunity for creators and investors in the space, it’s one pro that has brought many people into the space.

The great thing about NFT technology is that it cuts out the middlemen. As in, you create an asset, and then you can sell it directly to your consumer. That means the creator is in full control of their creations and how they sell it.

Furthermore, the creators aren’t the only ones who benefit from the economic upside. Consumers also have an opportunity to make a nice living buying and selling NFTs. Aside from the traditional day trading nature often seen in the NFT space, long-term investors have huge opportunities as well.

Many brands in the NFT ecosystem are still very new. So, as they are built out over time the value of their assets has the potential to increase. This leaves investors in good spot years down the line.

If you know how to buy a good NFT today, then the investment opportunity could be as lucrative as if you were an early investor in Facebook or Uber, for example.

2. Proof of Ownership

Proof of ownership is often advertised as one of the main benefits of NFTs. To be fair, there are still a ton of gray areas on the legal side of the technology, but nonetheless, the blockchain is completely transparent.

Since the blockchain is a digital, public ledger, anyone has the ability to see who owns an NFT. Not only that but there can only ever be one NFT. That means no one can copy the code of an NFT that’s already published to the blockchain.

That’s not to say that the underlying assets (images, videos, etc) can’t be copied; because they can. But the blockchain will always be able to prove who the original creator of an NFT is and who the current owner is.

3. Proof of Authenticity

Brands and creators all around the world have struggled with the issue of replications. Now with NFTs, there is no way to replicate a token that has already been published on the blockchain.

Again, you can copy the underlying assets of an NFT (just like I can take a picture of a car I don’t own and claim it’s mine), but when it comes to authenticity, the blockchain will expose any fakes.

My intuition tells me that physical products will soon come with an NFT as proof of authenticity. And since NFTs can’t be altered, there will be no way to replicate them.

Perhaps Gucci will provide an NFT for every one of their products. That way when you go to buy one of their products from eBay you can quickly check the blockchain to verify the authenticity of the product.

4. Promotes Transparency

If you haven’t already figured it out, NFTs promote a transparent way of living. This is beneficial mainly when it comes to transactions. Whether it be business to business, business to consumer, or consumer to consumer, NFTs benefit all types of transactions.

Any questions that a seller or buyer might have can truthfully and accurately be answered by viewing the data that’s stored on the blockchain. There’s no more lying about who owned something previously, how much it cost in the past, or how many hands an asset has passed through.

The blockchain reveals it all.

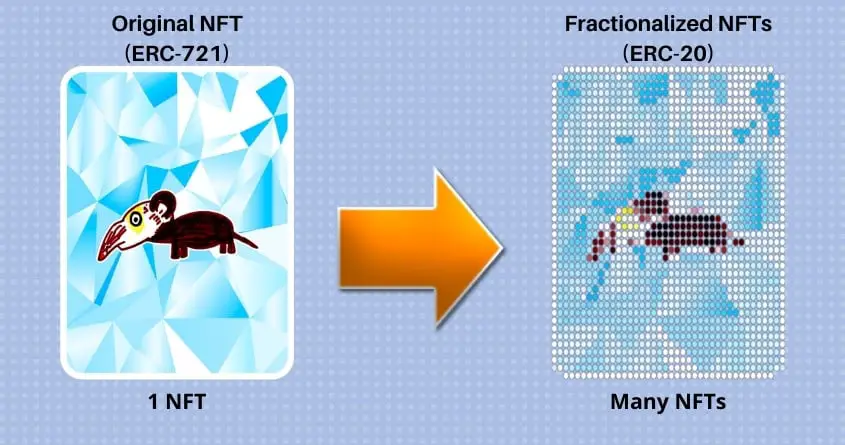

5. Fractionalized Ownership of Assets

Before NFT technology, it wasn’t easy to fractionalize ownership of physical assets like real estate or jewelry for example. Also, there was no such thing as digital ownership. But now, NFTs offer us a unique way to fractionalize ownership of both digital and physical goods.

The ability to fractionalize any asset through digitization means the market for certain assets can be expanded. Also, personal investment portfolios are enhanced because the digitation aspect allows for greater diversification of investments.

6. Creators Earn Royalties

One of the biggest game-changers with NFTs is the ability for creators to earn royalties for their hard work. Royalties are fees that the creator can set up to receive a percentage of every single secondary sale.

If there’s one thing we’ve been missing in the creator economy, it’s royalties. Think about it. Let’s say you create a piece of art. You then sell that art to someone else for $100. Then, 10 years later that person sells your art for $100,000 because you’ve built a reputation for yourself as an artist. But wait. You don’t receive any part of that $100,000 even though you did all the work. That just doesn’t seem right.

That’s why royalties are a game-changer. With NFTs, you can set a royalty percentage on your creations. That way if you were to set a 10 percent royalty fee on your art, you would automatically receive $10,000 from a $100,000 sale.

7. The Technology Is Secure

To function, NFTs use blockchain technology. Blockchain technology is immutable; meaning it can’t be altered after its published. As a result, the token that is stored on the blockchain cannot be copied or stolen by anyone.

Now, I know what you’re thinking. There have been many hacks and even claims of “stolen” NFTs, but these mistakes have all been the result of user error. The technology is solid, but humans will continue to make mistakes.

As the technology continues to advance, so will the security of NFT and blockchain technology.

8. Promotes Marketplace Efficiency

The world we live in today is all about speed. We want things fast! And though we have done a good job increasing marketplace efficiency with eCommerce mega-stores like Amazon, we can still do better.

NFTs offer us a way to get the things we want immediately upon purchase. You don’t have to wait days for packaging and shipping, you have something to show immediately.

Considering NFTs act as an immutable, digital representation of other assets, we can turn anything into an NFT without intermediaries—this also improves efficiency. So, even though you might not get the physical asset immediately upon purchase, you will have an authentic representation of that asset proving you’re the owner.

Also, considering the marketplaces are operational 24/7, there’s never a time when you can’t buy and receive your asset instantly.

Cons Of NFTs

1. They Can Be Used For Fraudulent Activities

While the inherent properties of NFTs and their underlying technology are not in question, they can still be used to perpetrate fraudulent activities.

Money laundering is one of the main concerns with NFT and related technologies. In fact, cryptocurrency has been used by criminals for years. The infamous dark website, Silk Road, utilized Bitcoin to conduct its illegal trading operations years before NFTs gained popularity.

My point is that the money laundering risks presented by NFTs are not unique to the technology, it is simply another avenue that criminals attempt to exploit.

2. There’s An Abundance of Scams

Where there’s money to be made, there are scammers to be found. According to a report by CNBC, Americans lost $29.8 billion dollars to phone scams alone in a single year. And if you think these professional scammers aren’t targeting the NFT space, you’re sadly mistaken.

The Federal Trade Commission reported that crypto scams cost people more than $1 billion in 2021 alone. Considering NFTs and crypto utilize the same technology that is so attractive to scammers, they are both at risk of being hit hard by the scam industry.

NFT wash trading is another concern, especially since scammers have already walked away with more than $9 million in 2021, and I believe that number will only continue to grow.

Ultimately, if you plan on getting in on the NFT trend, you should be aware of the top NFT scams and know how to avoid them.

3. You Could Lose A Lot of Money

Besides the abundance of scams, the likelihood that you will lose money investing in NFTs is high. No one knows for sure what will come of the NFT space. The only thing that’s for sure is that you are likely to lose money if you don’t put in the time to do your own research. And even then, you could still lose big.

Considering the volatility of the NFT and crypto market, it’s hard to say what will do well in the long run and what will fail. If I had to guess, I’d say that at least 98% of NFT brands will fail and plummet to zero.

That’s why it’s important to practice patience and accept that losing your hard-earned money is a potential outcome when investing in NFTs.

4. The Technology Is Still New

It goes without saying that NFT technology is still in its infancy. The way we view NFTs today will be completely different in the coming years. What started out as art with a little bit of utility is quickly evolving into utility with a little bit of art, and that transformation happened in just a year’s time.

With that, there’s no telling which blockchains will be around in the future or which brands will survive through the ups and downs. Currently, Ethereum is the preferred blockchain for NFTs, and brands like Bored Ape Yacht Club rule the market, but that can all change overnight.

5. There Are Many Gray Areas

With NFT technology still in its infancy also comes many gray areas. Many of these uncertainties are presented in a legal manner; such as what you actually own when you buy an NFT and other copyright-related concerns.

Although I believe many of these gray areas will be worked through over time, that doesn’t mean they aren’t a concern right now. For some of these issues to be solved, laws will have to be changed. And for laws to be changed, we need to expose and talk about these issues openly.

6. They Are Illiquid

When it comes to cryptocurrencies and other conventional commodities, you can quickly liquidate them in times of distress. But that is not the case with NFTs. Finding potential buyers for an NFT in times of distress can be challenging.

This is because the NFT market is still immature, and many people have not widely understood the whole concept. However, as brands continue to be built out over time and the true value of NFT technology is more defined, liquidating them will become easier.

Until then, you risk being stuck with your digital assets, especially in a down market.

7. NFT Technology Isn’t Always Environmentally Friendly

It’s no secret that NFTs consume a lot of energy. From minting to sale, one NFT on the Ethereum blockchain uses approximately 340 kilowatt-hours of energy. This is more than one-third of the energy a typical American home consumes in one month.

To be clear, not all NFTs consume this much energy. Ultimately, it depends on which blockchain the NFT lives on. Cardano, Flow, and Palm are examples of blockchains that are considered to be environmentally friendly.

But since Ethereum remains the most popular blockchain for NFTs, they get a bad rap overall, understandably. There is good news though! Ethereum is currently in the process of upgrading its blockchain to a proof-of-stake mechanism.

Since proof-of-stake removes high-power computing from the consensus algorithm, it’s claimed that the network will become 99.95% more efficient than it is today.

8. You Have to Pay Taxes on Gains From NFTs

Even though NFTs’ decentralized nature is appealing to many, that doesn’t mean that the government doesn’t still want their piece. Any profits realized from investing in NFTs are considered to be a taxable event.

So even if you are successful in generating some cash from creating or flipping NFTs, you are still subject to capital tax gains. Before you try to strike riches by investing in NFTs and avoiding your taxes, make sure you know what you are getting yourself into first.

Final thoughts

Overall, NFT technology is still in its infancy. Highlighting all the pros and cons are a necessary step in determining if getting involved in NFTs is right for you or not.

At the end of the day, no one is a true expert in the field, however, we can still use what we know about the technology and other historical data to help us better understand the future potential of NFTs to make the best decisions possible.